Beyond Carnaval: Challenges and Opportunities for Latam B2B Travel

Concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Welcome to I'm No Economist

I'm No Economist is a newsletter dedicated to deciphering Brazilian potential for global investment. Subscribe below to read it every week.

IN TODAY'S BEYOND CARNAVAL:

B2B Travel Boom in Latam

The Role Of TravelTech in Business Transformation

B2B Travel Boom in Latam

Latin America is quickly becoming a business tourism powerhouse, with cities like São Paulo, Mexico City, and Bogotá leading the charge. The region's expanding economy, improved infrastructure, and strategic trade agreements are making it a magnet for corporate travelers.

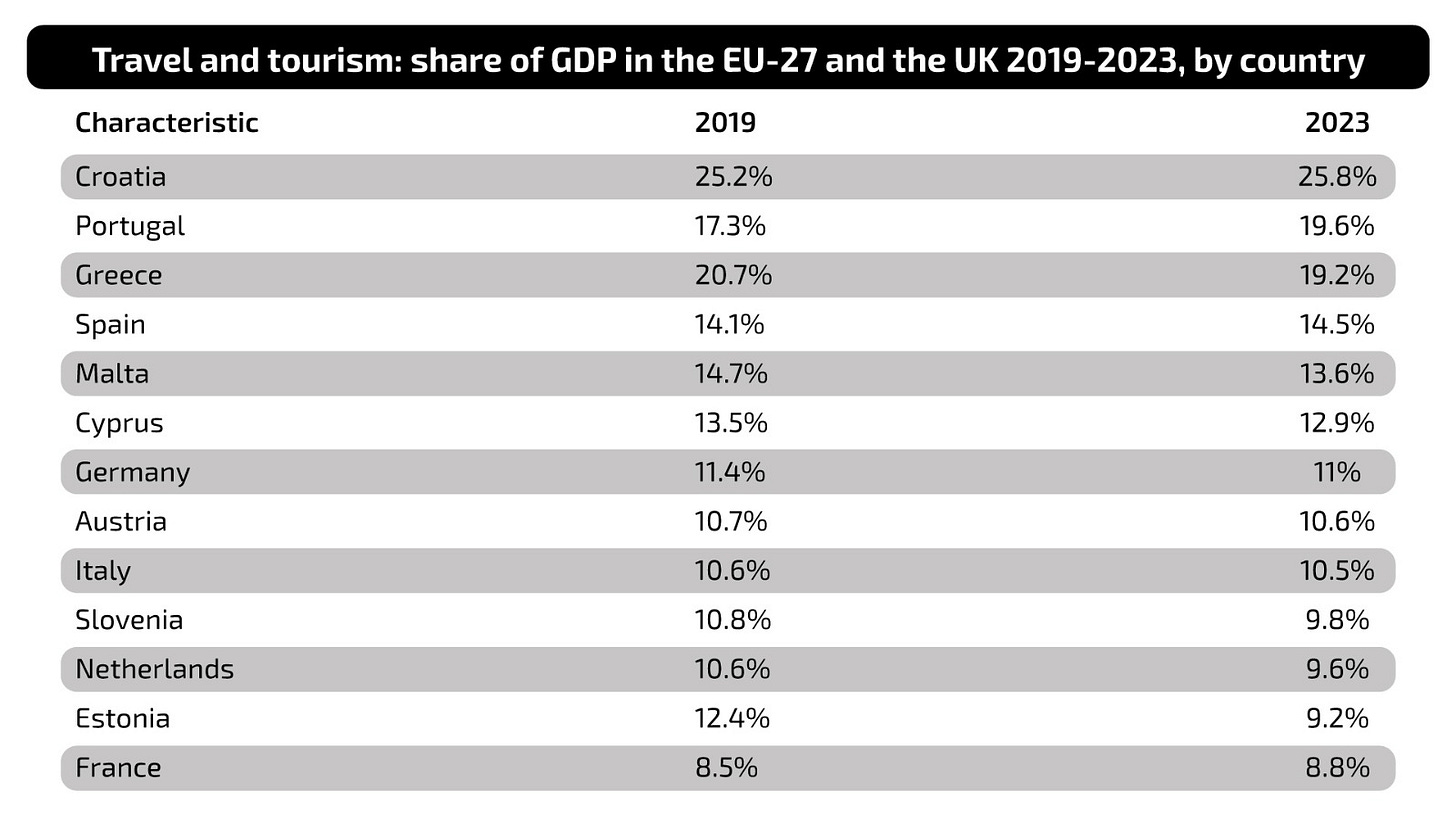

No wonder why Latin America is becoming a top-of-mind chosen destination for tourists. We're way warmer than the "tourists go home" protesters who choose to be left alone in their European motherlands. This is a weird behavior from our European friends since nowadays the major European business activity is being a big outdoor museum of Western civilization. But who am I to judge?

In contrast, even with its many leisure tourism destinations, Latam is becoming a major business tourism hub due to the significant investment in infrastructure across major cities.

Over the past decade, countries in the region have prioritized large-scale projects to modernize their airports, enhance urban mobility, and develop state-of-the-art conference and event facilities. Yet, while these investments have laid a solid foundation, there remain considerable challenges, particularly in transportation, that need addressing to unlock the region’s potential fully:

Airports: The Well-Developed Bit

A well-functioning airport network is crucial for business tourism, and several Latin American cities have taken decisive steps to modernize and expand their airports. El Dorado International Airport in Bogotá, often recognized as one of the best airports in South America in 2024 by Skytrax, has undergone major upgrades to accommodate increasing international traffic, improve passenger experience, and boost cargo capabilities.

Similarly, São Paulo’s Guarulhos International Airport and Mexico City’s AIFA (Felipe Ángeles International Airport) have expanded routes and services, reinforcing their roles as gateways for global business travelers.

Non-obvious cities like Brasilia have had an airport awarded in the top 5 best global airports in 2024 by AirHelp Score, and the only one in Latam among the five best, only behind three airports in Asia and one in Africa.

Event and Conference Facilities: High-Quality but Lacking in Number

When it comes to hosting large-scale events and conferences, Latin American cities have started to deliver world-class facilities. São Paulo boasts one of the largest concentrations of event spaces in the Southern Hemisphere, with venues like Transamerica Expo Center and São Paulo Expo capable of accommodating major international gatherings.

Mexico City and Buenos Aires offer a range of high-tech convention centers equipped with modern amenities, making them increasingly competitive on the global stage.

But, outside the primary business hubs, options become scarce, which could limit the region’s ability to attract events beyond a few key cities. Expanding the range of high-quality venues across more locations will be essential for broadening Latin America’s business tourism appeal.

COP30 the framework convention on climate change, which will be hosted in Belém-PA in 2025 will be an interesting trial of a non-obvious international destination for 150 delegations from all around the globe.

The city of Belém is expected to receive 50,000 additional tourists during the two-week event and will receive an investment in the order of R$ 1.3Bn (~$ 260Mn). According to Agência Brasil:

Of the total funds covered in the three agreements, most (some BRL 1 billion) will be invested in modernizing Belém’s roads and setting up the Doca Linear Park. Measures have also been planned for sanitation—like the construction of 50 kilometers of sewage collection system, the paving of roads to the COP 30 site, and the installation of traffic control equipment.

One thing is true: challenges call for opportunity

While progress is evident, transportation remains one of the biggest hurdles for Latin America’s business tourism sector. Inter-city connectivity is still a significant challenge, particularly given the vast distances between business hubs.

Why not high-speed rail? It's a common solution in Europe and parts of Asia, but largely absent in Latin America, forcing travelers to rely on either air travel or long bus journeys to move between cities. Additionally, secondary airports in smaller cities are often underdeveloped, offering limited international connectivity.

The Role of Traveltech in Transforming B2B Travel (And Business In General)

According to our friends at Latinometrics:

LatAm's biggest country has a massive flight industry: 12 out of the 30 busiest airports in the region are in Brazil. The national aviation market, meanwhile, is worth some $10B in annual revenue.

Not only aviation but a large part of the tourism industry is attributed to business travel. As we mentioned in the last edition of Beyond Carnaval:

[...] Onfly, they sent us material that estimated the total addressable market (TAM) for business tourism in Brazil and Mexico to be around $28 billion - but I'm No Economist did its own research and found out that number to be $32.5 billion combined - even bigger than previously estimated by Onfly.

Even though, yes, there are challenges in tourism infrastructure, there are B2B travel companies helping corporations streamline their travel processes: from booking a flight and hotel to managing travel expenses, B2B traveltechs isareenabling companies to manage their corporate travel more efficiently than ever before.

When remote is not enough - especially for companies that rely on relational transactions, the advent of travel technology is reshaping the B2B travel landscape in Latin America.

This is a huge leap forward for efficiency in doing business. First, you can count on a seamless process to make simple a complicated process. Moreover, you can focus on being in the moment doing business outside your main location: which is why you invest in traveling in the first place.

Now, can you imagine a world without B2B traveltechs to help companies invest in doing business with the mess we have in Latam infrastructure?

Based on Crunchbase's data, investments in Brazilian traveltechs have reached $29.8Mn in 2023 - 98% of what was invested in the sector in Latam. This is an important sum for the region. But it's still a long road for the growth of B2B traveltechs.

Especially because only one company, Onfly, bit ~50% of that total amount. Our sponsor for this edition provides a comprehensive corporate travel and expense management platform. They raised $16Mn in a Series A round in 2023, aimed at scaling its operations and enhancing its technology offerings for B2B travel.

Another example is Flapper, a Brazilian startup that is a private aviation marketplace that offers on-demand flights, shared charters, and empty-leg services across Latin America. They connect users with a range of aircraft options, from helicopters to jets, allowing them to book flights quickly and efficiently. They cater to both business and leisure travelers by offering flexible, luxury travel solutions. They have raised $10Mn until 2022 and an undisclosed Series A in 2024.

Flapper is an example of a Brazilian startup that shows how Brazilian Traveltech can expand beyond its regional borders. Now they serve Brazil which has a top 1 city in Latam for airport traffic, and Colombia, which is home to a top 3 airport. Not to mention their global expansion to the U.S. and Europe.

These startups are capitalizing on the increasing demand for innovative travel solutions in Latin America, driven by technological advancements and changing consumer behaviors. Their growth is indicative of a broader trend within the region's tech ecosystem, which is becoming increasingly more vibrant and more competitive.

Sure, we're a long way to go. But someone has to think outside the box. Our Brazilian traveltechs are on the right way and we're optimistic.

Anderson Thees to Lead Endeavor Brazil: Anderson Thees is the new managing director of Endeavor Brazil, succeeding Camilla Junqueira. Thees, a tech industry veteran and co-founder of Redpoint eventures, plans to drive the growth of decacorns—companies valued over $10 billion. His experience includes investing in several unicorns like Gympass and Creditas. (Source)

IRB Shares Surge After Positive Results: IRB Brasil’s stock jumped over 30% after posting a surprising R$ 65 million profit in Q2, despite significant flood-related losses. Analysts adjusted their recommendations upward (Source)

SP TechWeek 2024: SP TechWeek aims to bring together key figures in Brazil’s tech ecosystem for networking and growth opportunities (Source)

📩 Partner with I'm No Economist

Deciphering Brazilian potential. Generating expert intelligence and strategic insights for the Brazilian investment market.

Every Thursday 06:09 am (BR time), the Beyond Carnaval newsletter offers concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Delivered on the first Saturday of the month at 06:09 am (BR time), the Open Zeitgeist newsletter provides a space for both Brazilian and "gringo" guests to share their perspectives on Brazilian investment opportunities.

Investors are closely looking for opportunities in our country. It is our job to decipher Brazilian potential.