Beyond Carnaval: Is Latam Cooperation a Real Thing?

Concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Welcome to I'm No Economist

I'm No Economist is a newsletter dedicated to deciphering Brazilian potential for global investment. Subscribe below to read it every week.

IN TODAY'S BEYOND CARNAVAL:

We Are Brazilian Realists

The Role Of Latam Private Investors

The Role of the Mercosur

Nat Vasconcellos called our attention to how Europe can collaborate with Brazil to evolve the local innovation ecosystem. Besides the developed countries in the West, Latin American countries are increasingly turning their attention to Brazil as a hub for innovation, driven by both public and private sector efforts.

On the public side, regional agreements such as the Mercosur are working to harmonize digital standards, promote regulatory coherence, and enhance cross-border trade. These initiatives aim to build long-term, stable foundations for innovation by integrating infrastructure and other technologies across Latin America.

Meanwhile, private venture capital (VC) and startup ecosystems are accelerating Brazil’s growth, with a significant influx of capital fueling sectors like fintech and e-commerce. Who's doing it right, and can they collaborate between them? Let's dive into it!

We Are Brazilian Realists

As the largest economy in Latin America, Brazil serves as a focal point for both government-backed integration efforts and fast-moving private investments. This dual-track approach creates a dynamic landscape for foreign companies and governments looking to collaborate with Brazil on innovation projects, providing opportunities for both strategic, long-term partnerships and immediate business growth.

Brazil’s potential as a regional leader in innovation is vast, but the country still faces significant challenges. Even though infrastructure remains a critical hurdle, in many regions - particularly rural areas - Brazil’s internet penetration is around 82% as of 2023. Its large and increasingly tech-savvy middle class makes it an attractive market for investors.

Brazil's consumer base, with over 214 million people, is by far the largest in Latin America. Its growing digital economy, supported by a strong demand for online services and e-commerce, positions the country as a crucial player in the region’s tech scene. This combination of challenges and opportunities makes Brazil a complex but promising environment for innovation.

But Beware of a blind optimism. Our friend

from the newsletter (literally "On The Unicorn's Trail") sent out an edition of how Brazilian companies and investors should manage expectations - and I thought this should be said about Brazil:"The size of the population does not reflect the real purchasing power. The money circulating here is much more limited than it seems. [...] Those who don’t adjust their expectations end up building a company outside of reality. In the end, they remain in limbo: unable to scale, attract investment, and just burn through money."

The Role Of Latam Private Investors

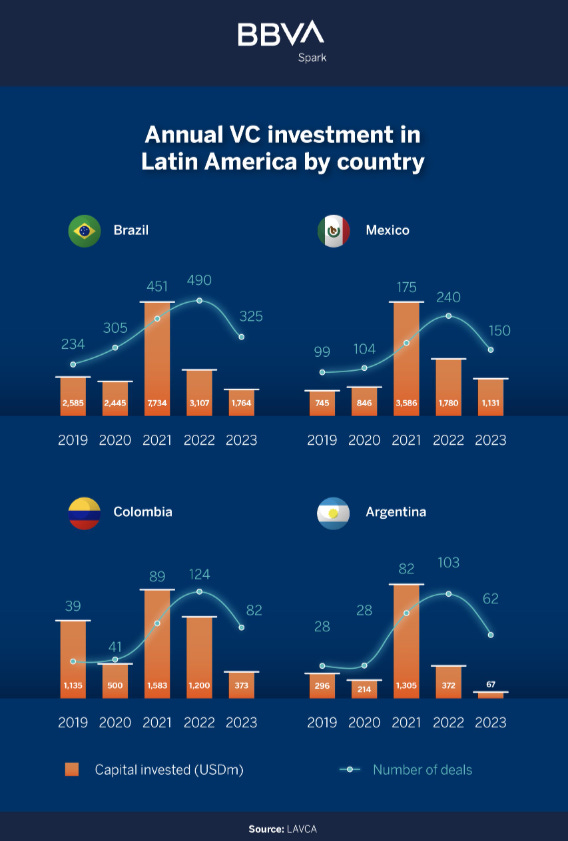

The private sector, especially through venture capital investments, has been a significant driver of Brazil’s innovation growth. In 2023-2024, Brazilian startups raised billions in VC funding, with fintech and ICT being the dominant sectors.

Firms like Kaszek Ventures, Monashees, and Valor Capital Group have been key players, funneling capital into Brazil’s burgeoning tech ecosystem. According to recent figures, Brazil captured over 43% of all VC funding in Latin America in 2023, with fintech companies like Nubank and C6 Bank continuing to attract large investments.

But, according to Spectra's annual investment letter of July 2024, in terms of financial performance, the median internal rate of return (IRR) for Brazilian venture capital investments is getting lower as vintages go by:

"[...]for investors entering the market in 2023, prospective future returns tend to be lower, all else being equal. As a hypothetical example of the impact of rising prices: if a local VC manager had achieved a 10x return on their fund raised between 2013-2017, and if that same manager had invested in the same companies with the same outcomes but paid 2023 prices instead of 2017 prices, their fund would have returned only 2.1x."

To improve outcomes, founders and investors should focus on realistic market expectations and address the infrastructure gaps hindering scalability - besides the size of the market and realistic valuations.

Understanding the true purchasing power and economic conditions is critical rather than being seduced by Brazil's large population and potential. VCs should also diversify their strategies, balancing short-term fintech investments with long-term infrastructure improvements to stabilize returns - instead of always investing in short-term software layers, there's space for deep tech investments for example.

The Role of the Government: Development Banks

Despite my efforts to take the government out of the equation for economic development, it's hard to ignore international trade block initiatives - for better or worse.

In December 2023, a significant boost to South American infrastructure development was announced, with development banks committing R$ 50 billion (around USD 10 billion) to enhance the region's connectivity. This initiative, known as “Routes for South American Integration”, was presented during the Mercosur Summit in Rio de Janeiro, and it represents the largest financial commitment in the history of Mercosur integration.

The funds, provided by institutions such as the Brazilian National Bank for Economic and Social Development (BNDES), the Development Bank of Latin America and the Caribbean (CAF), the Inter-American Development Bank (IDB), and Fonplata, aim to bridge the infrastructural gaps that have long hindered economic and social progress in the region.

These projects focus on improving transportation routes, energy connectivity, and digital infrastructure to enable smoother regional trade, faster communication, and greater productivity.

Key Infrastructure Projects

The Routes for South American Integration initiative is built around five major infrastructural corridors, which were identified after five months of consultations. These routes are:

Ilha das Guianas

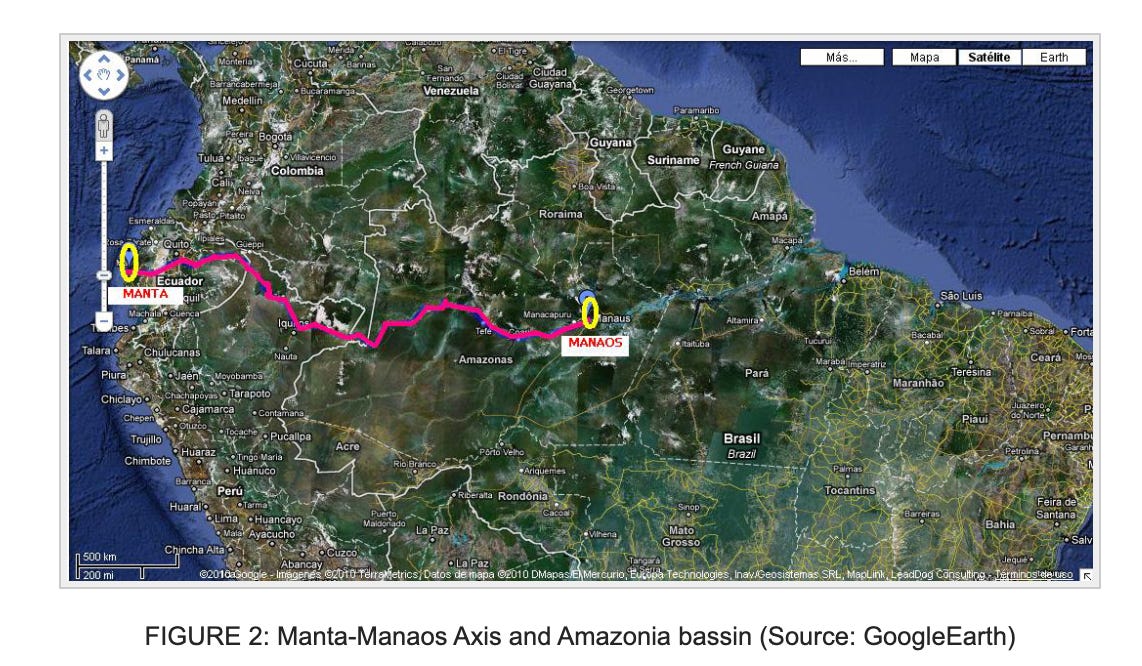

Manta-Manaus

Quadrante Rondon

Capricórnio

Porto Alegre-Coquimbo

Each corridor is strategically planned to boost trade and integration, particularly in areas where logistical bottlenecks have slowed growth. For example, the Manta-Manaus corridor connects the Brazilian Amazon to key seaports in Ecuador, opening up new trade routes while also promoting sustainable development initiatives in the region.

Challenges and Opportunities

While this initiative represents a huge opportunity for South America, challenges remain. The vast geographic and economic disparities between countries like Brazil and smaller Mercosur members (Paraguay and Uruguay) require nuanced approaches to implementation. Historically, such projects have faced delays due to bureaucratic hurdles, political differences, and insufficient funding - what a surprise.

However, the coordinated support from multiple development banks, each with a clear mandate to support regional integration, presents a promising path forward.

The Road Ahead

With the funding secured and strategic routes defined, the Routes for South American Integration initiative has the potential to reshape South America's economic landscape. Not only will it address the logistical inefficiencies that have long plagued the region, but it will also pave the way for deeper economic collaboration and a more connected digital economy.

As Brazil takes a leading role in this ambitious plan, its success could offer valuable lessons for regional cooperation and development globally.

Now, if they're right infrastructure investments - that's another 2000-word article.

Eve, Embraer's subsidiary, secures BNDES funding: Eve, Embraer's urban air mobility arm, is set to build a new manufacturing facility with R$ 500 million in funding from BNDES. The plant will focus on producing electric vertical take-off and landing (eVTOL) vehicles, marking a significant step in Brazil’s electric aviation sector. Source

Serasa's 14th acquisition in four years, Clearsale: Serasa Experian has made its 14th acquisition in four years by purchasing fraud-prevention company Clearsale. This move strengthens Serasa’s presence in the fraud detection and data analytics sector as part of its aggressive expansion strategy. Source

Widespread power outage hits São Paulo: A power outage affected several regions in São Paulo, disrupting services and daily activities. The causes of the blackout are under investigation, and authorities are working to restore full power as quickly as possible. Source

📩 Partner with I'm No Economist

Deciphering Brazilian potential. Generating expert intelligence and strategic insights for the Brazilian investment market.

Every Thursday 06:09 am (BR time), the Beyond Carnaval newsletter offers concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Delivered on the first Saturday of the month at 06:09 am (BR time), the Open Zeitgeist newsletter provides a space for both Brazilian and "gringo" guests to share their perspectives on Brazilian investment opportunities.

Investors are closely looking for opportunities in our country. It is our job to decipher Brazilian potential.