Beyond Carnaval: Why is Europe Looking to Brazil?

Concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Welcome to I'm No Economist

I'm No Economist is a newsletter dedicated to deciphering Brazilian potential for global investment. Subscribe below to read it every week.

IN TODAY'S BEYOND CARNAVAL:

Europe's Business Ecosystem

What Brazil Has to Offer to European Business

Euro-Brazilian Initiatives

We are not naive — it’s no secret that sometimes it’s hard to defend Brazil. Yet, despite the challenges this continental-sized country presents, many foreign businesses remain keen on expanding into its market.

Clearly, there’s something special about Brazil, right?

After coming across some companis experiencing this expansion moment, we thought "Why not explore global businesses' motivations to enter the Brazilian market and the current bilateral innovation initiatives?!"

That's why, these next editions will be dedicated to investigate more this topic.

And today, we are starting with Europe.

After living in Lisbon for nearly two years and engaging with the local entrepreneurial ecosystem, it's only natural that I come across rising businesses. One such case is WeTransact, a French startup founded in Lyon in 2023.

With part of its team based in Lisbon, WeTransact helps companies leverage Microsoft’s Marketplace, ensuring that their investments generate tangible, scalable returns.

WeTransact’s expansion is an interesting case of Europe-Brazil business ties. Mainly because the company has already expanded into several regions, including Europe, North America, Asia-Pacific, and some Spanish-speaking countries in South America. Brazil wasn’t their first choice for expansion, but the team eventually decided the timing was right.

One of the main reasons for that is Brazil’s high cloud and virtualization adoption rates are higher than in many other countries. Currently, 27% of companies in Brazil use cloud applications, surpassing the global average of 18%.

Though WeTransact's entry into Brazil is still recent, the market response has been encouraging. Their partnership with local companies have highlighted the growth potential they were aiming for. Looking ahead, they see Brazil as a strategic market and are planning to expand its local team to better support this growth.

This is not me saying, but the team itself.

Europe's Business Ecosystem

European businesses operate in highly developed and competitive markets, where innovation, sustainability, and quality are key pillars of success. According to the 2024-2029 priorities of the European Union, these elements are central to the continent's competitiveness. However, factors such as local market saturation, resource constraints, and high operational costs are prompting European companies to seek expansion opportunities abroad.

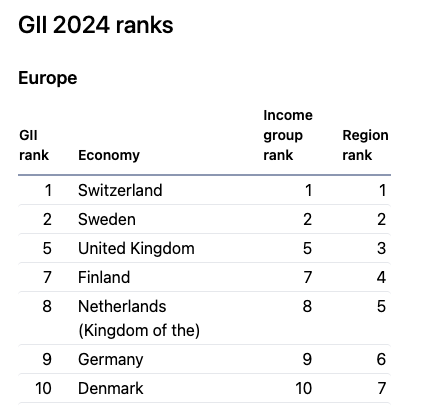

Europe remains a global leader in innovation. In fact, seven out of the top ten countries in the 2024 Global Innovation Index are European nations.

A key feature of the European business ecosystem is its strong emphasis on sustainability and environmental responsibility. The European Union’s Green Deal is a prime example, pushing companies — particularly in energy, transportation, and infrastructure — to innovate and reduce their carbon footprints, with the goal of achieving net-zero emissions by 2050.

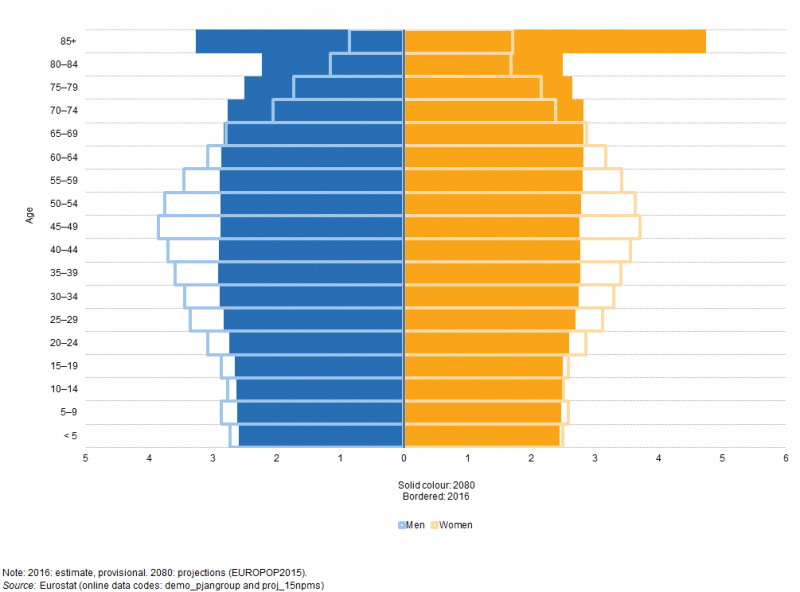

Despite its innovation leadership, many European domestic markets are becoming saturated, while an aging population is limiting demand for consumer goods. This is particularly evident in industries such as FMCG (Fast-Moving Consumer Goods), automotive, and consumer electronics, where slower growth is partly attributed to these demographic trends.

Another challenge for European businesses is the relatively high cost of operations compared to other regions. High wages, steep energy costs, and stringent labor laws make it expensive to run large-scale manufacturing operations in Europe. This is especially problematic for industries that depend on mass production, where cost efficiency is critical to maintaining global competitiveness.

What Brazil Has to Offer?

On the other hand, Brazil offers a combination of a growing consumer market, a vast number of natural resources, and emerging opportunities in innovation and sustainability, being a non-obvious choice, but an attractive destination for European companies seeking expansion.

With 214 million people, Brazil is the largest market in the region, driven by a rising middle class eager for high-quality goods and technology. The country’s GDP reached $2.06 trillion USD in 2023, solidifying Brazil’s standing as a key player in the global economy.

The country's strategic geographical location serves as a gateway to the wider Latin American region, providing a platform to expand not just within Brazil, but to neighboring countries allowing an operations scale across the continent.

According to André Vieira Scherer, a Brazilian Open Innovation Specialist who works closely with startups globally, businesses are increasingly drawn to Brazil due to its market size and relatively low entry costs compared to other regions. Agreeing with WeTransact, he also emphasizes the high adoption of digital solutions by the population, making Brazil an appealing target for expansion, especially from the Agriculture, Energy, Construction, Finance, Health, and Logistics sectors.

Euro-Brazilian Initiatives

As you might have noticed by now, it’s no coincidence that some of Europe’s most innovative countries are strengthening their ties with Brazil for the long term. Several European innovation and trade agencies have established local branches in Brazil to drive bilateral initiatives, facilitate partnerships, and foster long-term collaboration.

Below are some notable examples from European countries that are strengthening their ties with Brazil, focused especially in developing business and innovation:

Switzerland: Swissnex Brazil is part of a global network that fosters collaboration in education, research, and innovation. It connects Swiss entrepreneurs and researchers with Brazilian counterparts, encouraging scientific exchange and supporting startup growth in sectors such as biotech and digital health.

Sweden: The Sweden Brazil Innovation Initiative (SBII) focuses on sustainability and technology transfer, promoting joint projects between Swedish and Brazilian companies, particularly in clean tech and green energy.

United Kingdom: Catapult Energy Systems helps accelerate the UK’s energy innovations by supporting local startups in expanding into Brazil. The Open Innovation Programme primarily focuses on renewable energy projects and advanced energy storage solutions.

Finland: Business Finland assists Finnish companies in accessing Brazil’s ICT (Institute of Science and Technology) and clean energy markets. It promotes technology exchange and innovation, particularly in smart cities and sustainability.

Netherlands: The Netherlands Innovation Attaché Network Brazil supports Dutch innovation in Brazil, with a focus on sectors such as agriculture, water management, and sustainable urban development.

Germany: DWIH São Paulo (German House of Science and Innovation) and GIZ (German Society for International Cooperation) play critical roles in promoting technology transfer and sustainable development between Germany and Brazil, focusing on areas like renewable energy, industrial innovation, and environmental protection.

The growing collaboration between Europe and Brazil is clear and it reflects a shared interest in innovation, sustainability, and long-term growth. European businesses and agencies are increasingly recognizing Brazil's potential, not just as a consumer market but as a key player in sectors like digital transformation, renewable energy, and advanced technologies.

Spoiler alert: We will talk more about the huge IT infrastructure investments AWS - a North American business - did recently in Brazil in the next editions.

These collaborations are opening doors for knowledge exchange, technological advancements, and sustainable business practices, benefiting both ecosystems.

The Brazilian market, with its dynamic entrepreneurial landscape and increasing demand for digital solutions, offers European businesses fertile ground for innovation and mutual growth. This partnership promises to unlock new opportunities, driving progress and success for both regions.

Industrial Decarbonization Funding: BNDES, Brazil's development bank, has allocated R$10 billion to finance industrial decarbonization. The program aims to support projects that reduce greenhouse gas emissions, promote energy efficiency, and adopt clean technologies. Companies can request financing of up to R$150 million per year. (Source: Valor)

Moove IPO Delayed: Moove, Cosan's lubricants arm, postponed its IPO due to global investors citing "Brazil risk." The company aimed to raise R$3.3 billion but faced challenges amid market volatility. Despite strong fundamentals, Moove couldn't secure desired valuation, reflecting broader concerns about Brazilian investments (Source: Brazil Journal)

Asaas Secures Funding: Brazilian fintech Asaas raised R$820 million in a funding round led by Mary Meeker's Bond Capital, with participation from SoftBank and 23S Capital. The investment values Asaas at R$5.5 billion. The company plans to use funds for expansion and potential acquisitions. (Source: Brazil Journal)

Brazil's GDP Forecast: World Bank revises Brazil's GDP growth projection for 2024 to 2.8%, up from 2%. The forecast for 2025 is 2.2%. The bank cites potential interest rate cuts by the Federal Reserve as a factor that could ease inflationary pressures in the region (Source: Exame)

📩 Partner with I'm No Economist

Deciphering Brazilian potential. Generating expert intelligence and strategic insights for the Brazilian investment market.

Every Thursday 06:09 am (BR time), the Beyond Carnaval newsletter offers concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Delivered on the first Saturday of the month at 06:09 am (BR time), the Open Zeitgeist newsletter provides a space for both Brazilian and "gringo" guests to share their perspectives on Brazilian investment opportunities.

Investors are closely looking for opportunities in our country. It is our job to decipher Brazilian potential.

👏🏻👏🏻👏🏻👏🏻