I'm No Economist #1: Overture, My Portfolio & Investment Strategy for 2022, Returns so Far

As the renaissance personality whose name I carry, I like to think I am a polymath.

I stink at writing traditional CVs, so I decided to write one similar to the one Da Vinci sent to the Dutch of Milan.

My main interests circle: technology, investments, marketing, venture building, economics, philosophy, mental models, nutrition, calisthenics, pankration, and hip hop.

To give you a bit of context, here is some of my professional experience:

Brief experience note:

I have worked with global founders since the beginning of my career (almost 10 years ago) and was fortunate to generate enough value for one of these companies to become a Jr. partner. This company grew to be one of the fastest-growing legal tech companies in Brazil.

I have specialized and worked in marketing, especially paid media and business intelligence since my company, acquired in 2021 specialized, in that.

Right after the sale of my company, I had the opportunity to put some of the skills learned in building a company into Innovation Consulting. I was fortunate to collaborate with industry leaders in deep tech challenges such as sustainability, energy transition, energy storage, and others.

I have personally been investing in crypto since 2018 and not by destiny I started working as a Media Specialist at the biggest crypto exchange in LATAM. Since Nov 2021 I've been tackling the challenge of making crypto useful for all the orphans of a good crypto solution in Brazil.

Aside from that, I have been studying economic cycles for the past year. It taught me a lot on how to make better investment decisions and made me a profit with a great adjusted risk/reward ratio of 15%+ return YTD.

And that's what I'm here to talk about on the I'm No Economist.

You can find more of my formal professional experience on Linkedin.

Why I'm No Economist:

Well, I majored in Leisure & Tourism at Universidade de São Paulo (Brazil's Ivy League school) at the end of 2012. Since I finished school, I can't remember when was the last time I have been to an official educational institution.

But I've never stopped studying. In fact, it only started my learning process. My interests in creating value have just grown exponentially since then.

I started studying things that school never taught me. Simple things like how money works, how people get rich, how to create generational wealth, how to make an impact so significant to ensure the planet is going to be there so many generations can enjoy all of that value creation.

This newsletter is the synthesis of all of those studies. I'm sure you're going to capture some of the value synthesized in this newsletter.

For the rest of 2022, you'll be joining me on this journey.

I decided to share my investment strategy, my research, and my decision-making.

Let's start from the beginning.

2022 Goals:

For this year, my goal is to beat the S&P 500 while doubling AUM. So far, it's going well, as the S&P 500 is down -4.35%.

By the end of the year, I want to have enough liquidity to invest in riskier markets with better returns. Such as accelerating my angel investing investments, VC, PE and others.

The important part is that my plan includes doing it publicly. I'll build this portfolio and beat the markets - or be beaten by it - while you watch.

My Portfolio and Investment Strategy for 2022:

I believe in having skin in the game. That's why I'm showing you my positions as of Jan 2022. I'll update it every month so you can see the results of the portfolio. This will hold me accountable.

But this is absolutely NOT investment advice. Do your own research.

I have been taking a hedge fund-like approach since Dec 2020 and it's worked me well. Without taking into consideration the new money I put in, It's gotten me a steady 15% yearly return, measured in USD.

It's higher in BRL (Brazilian Real), but that's not even a serious currency, so let's not measure it that way. BRL lost 85% of its value since its creation in 1994.

And look, don't take it the bad way. That's the best currency Brazilians had for the past 100 years.

We suck at monetary policy. But at least we're learning.

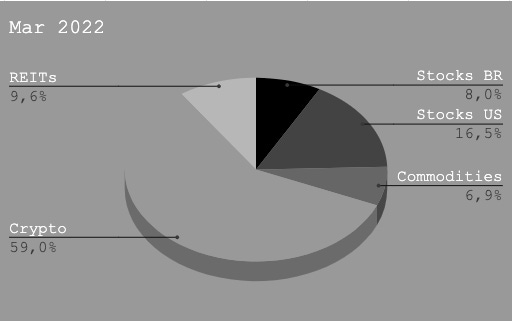

The strategy consists in having a percent goal for each asset class. For example:

50% should be in crypto;

20% in US stocks;

10% in BR stocks;

10% in REITs;

10% in commodities;

Each of these asset classes has its own mix of assets and each of its position goals. i.e.: there are 20+ crypto tokens inside of this asset class position, same for REITs, commodities, and so on.

They also have their own percent goal for cash reserves. That way if there are opportunities, I can then allocate to rebalance the percent goals for each asset inside of that particular class.

Following the same rationale, if any of the assets get too high a price, I must sell to recomposition my cash reserve goals and everything falls into place again.

This investment philosophy takes into consideration the Convexity Principle by Nassim Taleb.

This principle means, in a very rudimentary explanation, that your position has more to gain than to lose. Even if it means losing a little bit every day, but getting a huge pay-off by the end of a given period: month, year, decade.

Without further ado, this is my portfolio for 2022:

REITs (Real Estate Investment Trust): this is the only new thing for my portfolio in 2022. I've been reading a lot on the real estate investment cycles, and with the rise of interest rates by the FED, I learned that this is the buy year for REITs. For the Brazilians reading, I'm not talking about Brazilian FIIs (Fundos de Investimento Imobiliário). I have no interest in investing in Brazilian securities. This part of the portfolio is made out of ~15 REIT tickers. There is 8-10% reserved in USD inside of this asset class to leverage some opportunities when necessary.

Crypto: the apple of my eyes. Even with the terrible results from putting some money in May 2020, this part of the portfolio generated 83% from Jan 21 to Jan 22. Not too bad. This part of the portfolio is made out of 20+ cryptos, being BTC the most important one. There is a 5-10% USD reserve in case of opportunities.

Stocks BR: made entirely of USD cash reserves. There are no stocks on this portfolio, only the USD optionality once I realize it's time to take advantage of the tanking of Brazilian stocks. I'll probably just buy an ETF here when it's time.

Stocks US: made out mostly of USD reserves, since I believe that the US stock market has no business being this expensive. Fundamentals are crap, nobody knows what they're doing. I made some mistakes last year by buying gold miners and gold ETFs on their all-time high. But I'm hoping to get at least break-even this year or next with the rise of inflation.

Commodities: this part of the portfolio is composed of SLV and USD reserves. I'm thinking of spending some of that cash on other commodities, mainly water and others like corn, coffee, soybeans. But not sure yet.

As of March 2022 it looks like this:

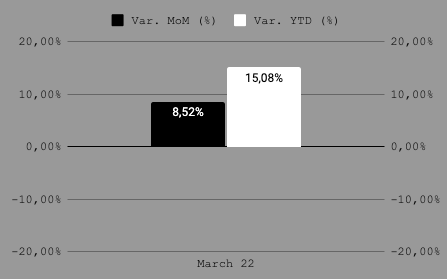

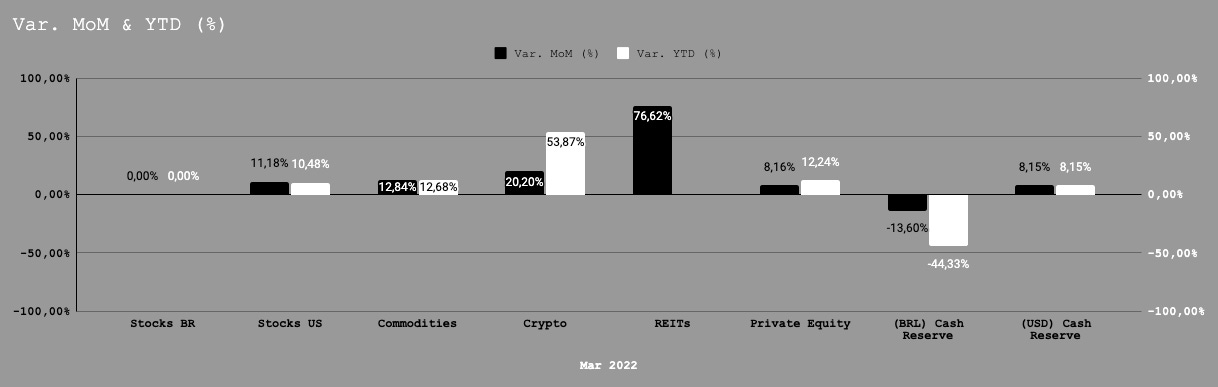

My returns so far this year:

I'm still trying to understand what's the best way to track them.

For the time being, I'm just calculating the asset balance variation MoM and YTD. Simple returns.

Once I have more data (a quarter or two), I'll then change it to Time-Weighted Returns.

By the end of the year, I'll calculate the annualized returns, using the IRR formula.

Only time will tell more about the calculation accuracy. Bear with me.

These are my returns so far (Feb 22):

Going forward on I'm No Economist:

I'd like to thank you for getting to the end of this edition.

Before I write my tender goodbye, bear in mind there is something else I'm not writing this time, but that you're going to read going forward.

I have many interests, as you saw previously.

Which means I'm always studying and reading and consuming content. This content consumption gives me a lot to think about, and I'll be sharing it in the future.

For that, I created a section dedicated to the synthesis of my own research on various topics.

For the next edition, I'm already planning something that has to do with Energy Tech, VC Investing in Energy Transition, and the State of Public and Private Investment in the Energy Sector in Brazil.

I'm super excited!

See you next time!

L.