I'm No Economist #12: 🤔 Does Size Matter?, Alternative Investments For The Win, Global LP Survey

Take no advice from me. I'm No Economist.

SS&C Intralinks and Private Equity Wire collaborated on their 7th annual LP survey. This survey paints the picture of how LPs dealt with their last year's allocations and what they're planning for 2022.

Actionable insights:

70% of LPs are expecting to allocate more of their portfolio to alternative investments, as public markets seem to be generating fewer returns;

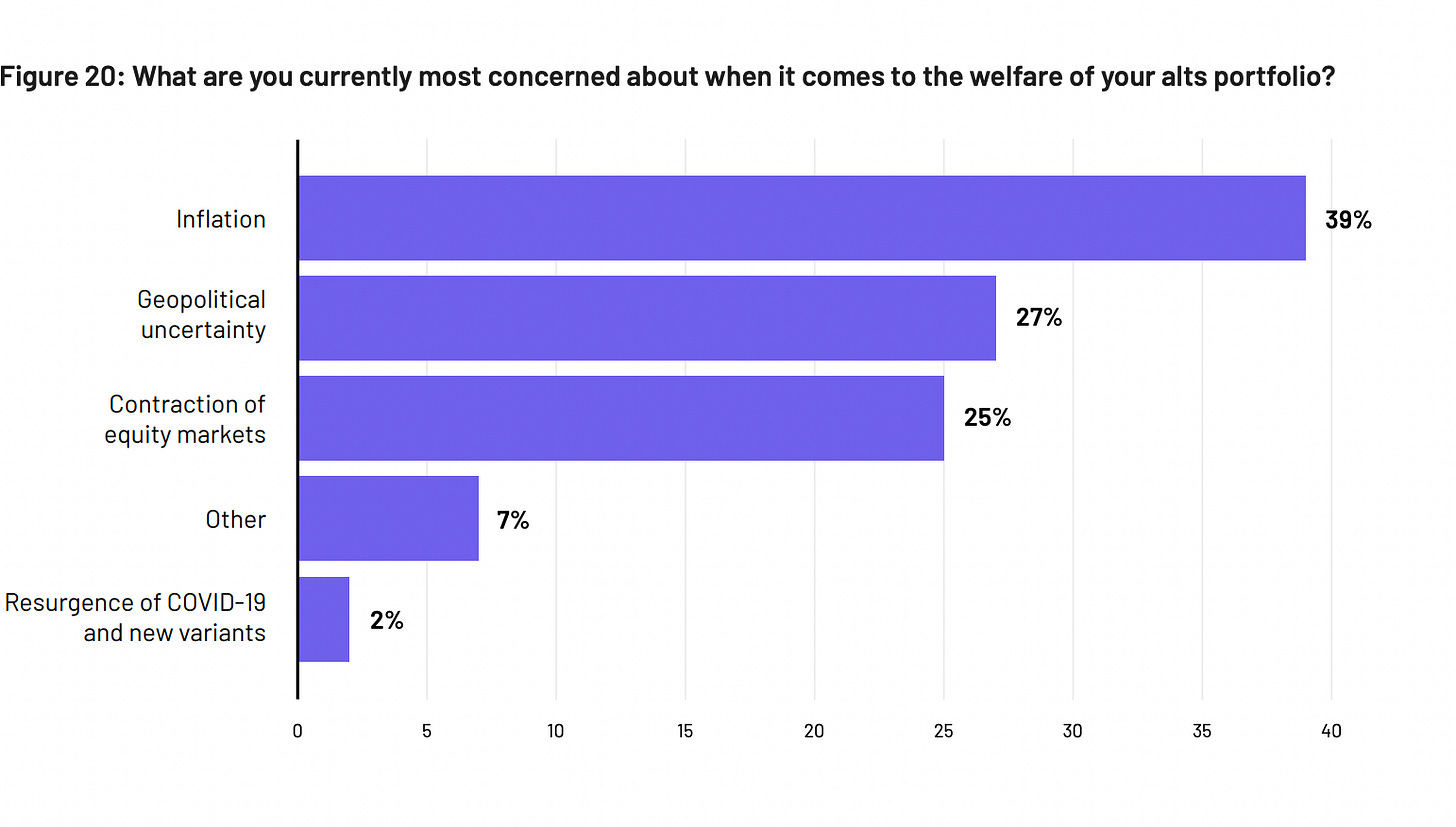

It's clear that inflation and interest rate increases defined a new era for LPs. They are now reallocating to infrastructure, energy, and everyone's favorite: technology;

LPs are unhappy with how they get reports: there's a lack of transparency on the way GPs communicate results, and GPs don't seem to be using tech to help their LPs get said transparency;

Emerging managers have to differentiate from big-name brands by choosing an interesting niche and finding interesting return opportunities. But they don't have to worry too much about management fees;

ESG will be a priority for the quarters to come. GPs can expect to have the demand to find investment opportunities in that arena;

Welcome to another edition of I'm No Economist 🎉

I'm No Economist is one of the best ways to get news - mostly opinions - on investment strategies, report digests, VC, startups, innovation, and macroeconomics.

If you are as opinionated as I am and if you know people just like us, share I'm No Economist with them. Let's all be opinionated together.

Alternatives are the most popular on the street

Alternative investments - and private equity as an LP asset class - is due to get an increase in allocation. Not only the public markets are muddy right now, but buyouts are downsizing. That makes alternative investments become a priority for LPs.

70% of respondents across all geographies (EMEA, APAC, LATAM, and North America) expect to increase their private equity allocations by 10% or more - venture capital excluded since buyouts will be more difficult I reckon.

Despite the fear with public markets, hedge funds come second as the asset class to be receiving an allocation from LPs. As inflation rises and public markets become more challenging to navigate, one would think that venture capital could become a candidate for second place after private equity.

Now, I believe hedge funds are getting money due to their flexibility to invest in multi-asset strategies and capture some of the return generated by deflationary asset classes such as Real Estate, Infrastructure, and Commodities.

Personally, it comes as a surprise to me that infrastructure did not come as a top 3 priority for LPs. Especially because there are banks, sovereign wealth funds, pension funds, and family offices that are particularly interested in maintaining national sovereignty - wherever they're based. Especially with the decrease in globalization and the weird times we're living in.

Does it matter how big a GP is?

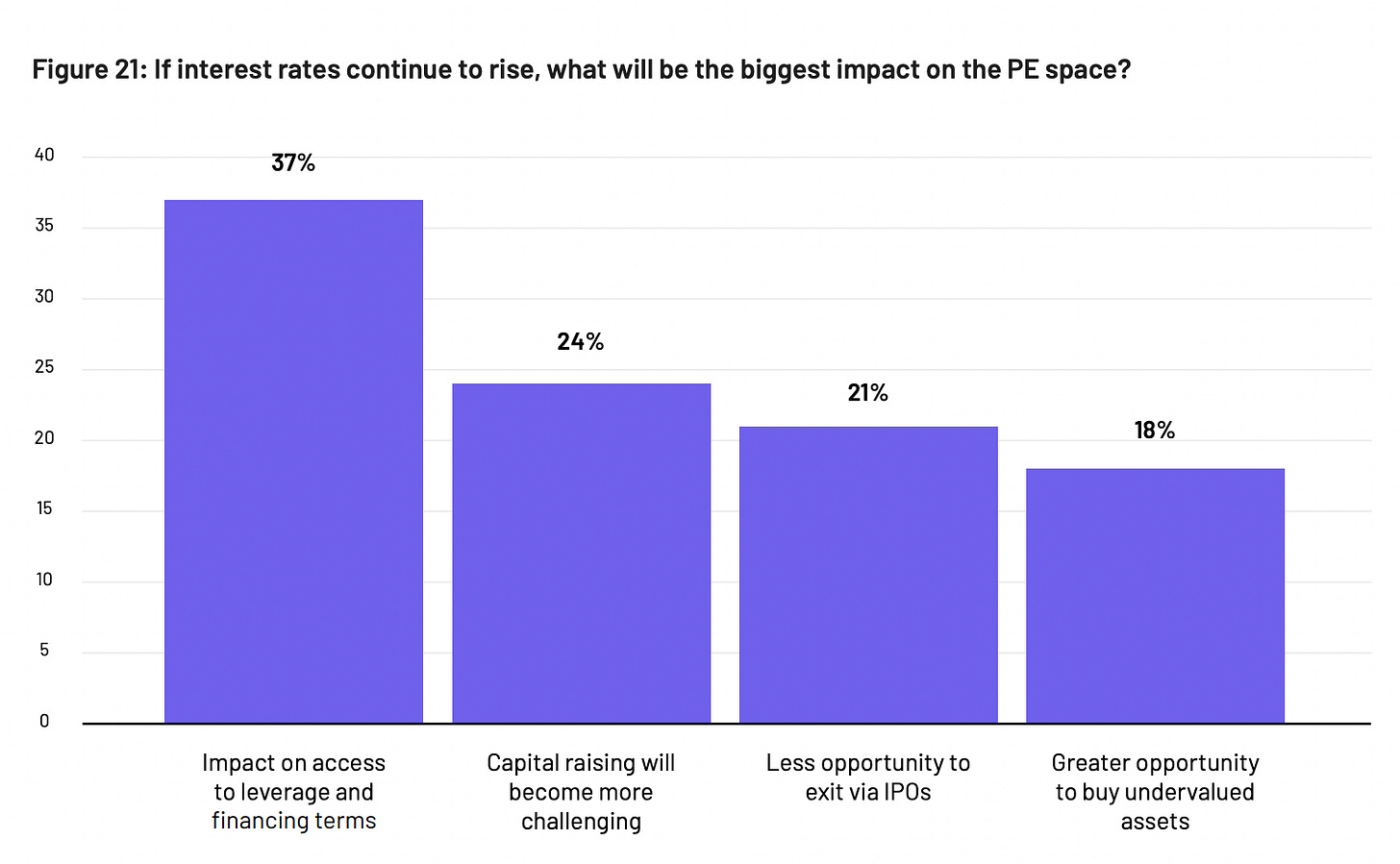

Yes, fund size matters. Especially in high-interest, high-inflation periods.

The preferred ranges vary between $100-500M AUM and more than $1B AUM, accounting for 74% of the preference of LPS. But big brands may become the preferred names in the near future.

Energy Transition and Infrastructure are capital-intensive themes that require large funds and a long-term strategy that only big names in the private equity industry are more susceptible to success.

KKR, for example, raised a $17bn infrastructure fund (more than $10bn larger than its previous fund for infrastructure investments).

However, there are still issues with funds larger than $5bn AUM. There's a concern from investors that there is just too much money being raised and that may be a problem for efficient asset allocation and returns.

One more time, a problem created by net-zero interest rates and an absurd increase in the money supply. This poses a challenge for emerging managers, that have to differentiate from big brand names even more carefully and strategically.

How's it looking for emerging managers?

Probably not as good as it was 2 years ago. But there are interesting prospects for managers that find a niche to work on and find investment opportunities in areas that are overlooked by GPs.

Besides, every investor likes a well-thought-out investment thesis. LPs are interested in attractive investment return opportunities and their appetite for an interesting tech could be a decision-maker for an LP allocation.

The good news is that LPs are not usually trying to find emerging managers to squeeze better fees out of them. New talent and portfolio diversification are a major priority over a few basis points.

Now, for either emerging or proven managers, keeping their relationships is a key factor to success. That relationship management will have to improve, as LPs complain about a lack of transparency and bad reporting from GPs.

Besides, more frequent communication with LPs would be a quick fix for most LPs, while better tech and analytics are being developed to be delivered by GPs.

Are LPs walking the ESG talk?

Despite the interest in ESG, from what I read in this report, ESG is not a decisive factor when choosing a GP.

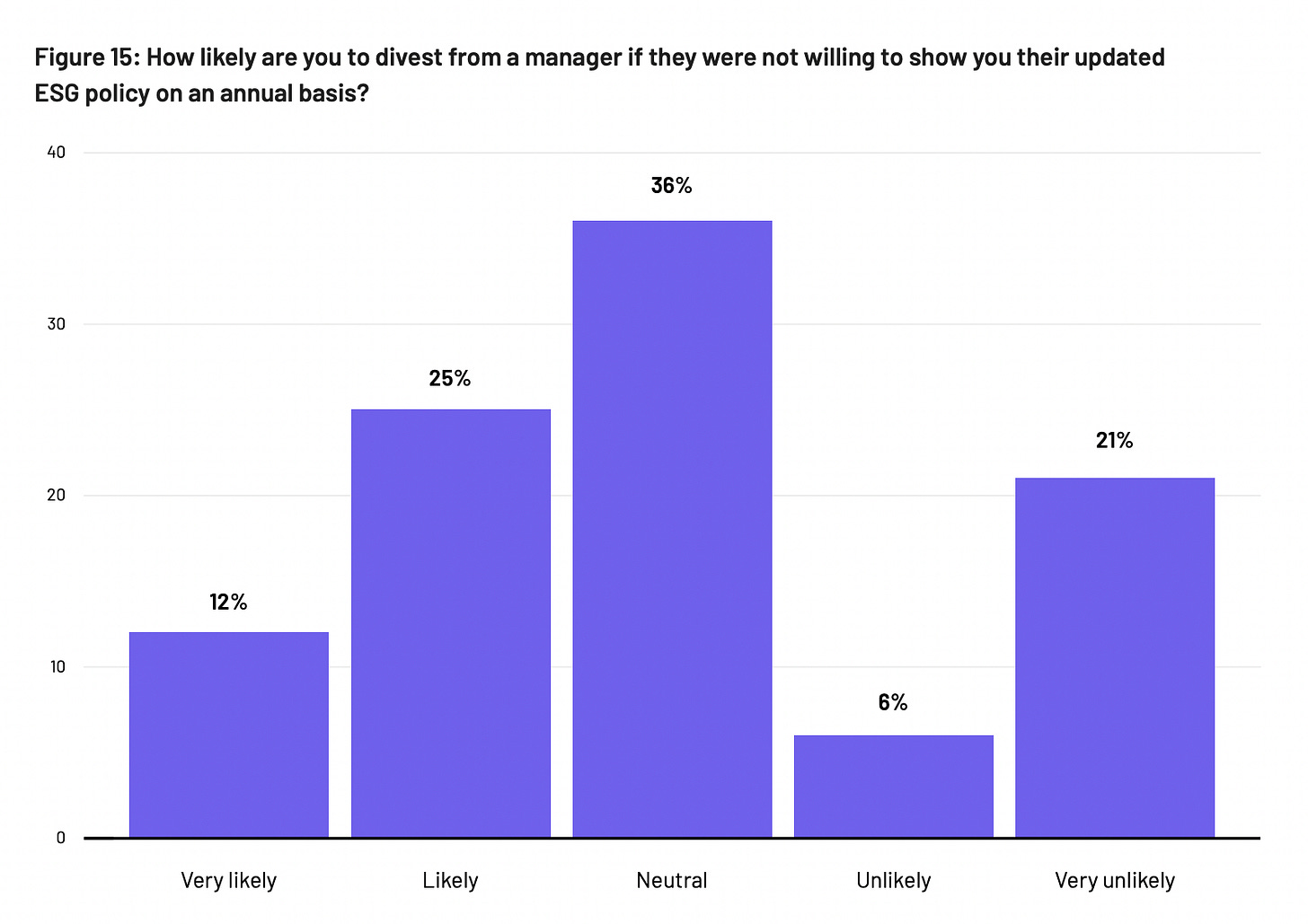

When asked if LPs would divest from a manager that is not willing to show their annually updated ESG policy, more than half are neutral or find it unlikely to do so.

I don't think that this approach to making investment decisions is bad per se. Or if that is bad at all, for that matter. I just think it's interesting to see what's making LPs really lose sleep.

What's really in everyone's minds is the macroeconomic scenario and the risks and opportunities that come from it.

If inflation starts to rise and rise, I bet ESG won't go through their minds, but how difficult and from where the money comes.

That said, it's important to point out that the sectors LPs are most interested in are ESG-adjacent. Renewables, Healthcare, and Infrastructure are sectors that have the sustainability factor built in themselves.

Not to mention that other sectors can develop society in many ways by just innovating and making sure they are making a positive impact in how they are being used. Tech is one of them, but Financials and Consumer Goods & Services are also great candidates for ESG practices.

What I've been reading/listening

I consume a lot of content to come up with I'm No Economist. Not only to produce content but because I'm a curious person. I thought it would be a good idea to create this section and share some of the content I've been consuming lately. Let me know what you think of this new section in the button below!

I'm finishing one of the most incredible biographies I've ever read: Irineu Evangelista de Sousa's or Visconde de Mauá. Jorge Caldeira - who was recently immortalized by the Brazilian Academy of Letters (ABL) - does an amazing job of describing the Brazilian economy in the decaying Brazilian empire in the second half of the 19th century. For those of you who know me, I'm obsessed with Irineu and I'm amazed by his biography. Here's a picture of me and him at the Centro Cultural Banco do Brasil in Rio de Janeiro:

Kyla's newsletter on Language, Loneliness, and AI. I was already a TikTok fan of Kyla and her amazing minute-long macroeconomic analysis. But she's leveling up her game with philosophical and behavioral analysis of contemporary society. Great read!

OPEC+ Wants to Keep Curbing Oil Production. I'm worried about how we're scaling with sanctions and how it impacts global oil prices and energy transition.

Useful Charts’ brief history of the world. I'm a visual learner. This is a great explanation of global history in a nutshell. He makes an interesting point about all important pivoting moments in history. They all come after pandemics, wars, or weather events.

Subscribe to I'm No Economist 📊

If you liked this content and want to stay informed with easy-to-digest content, make sure to subscribe to the newsletter!

Talk soon,

L.

Fenomenal!!

Fenomenal!!