I'm No Economist #2: My Dying Cynicism About The Energy Transition Landscape, VC on Energy Innovation, What Would "I'm No Economist" Do?

Take no advice from me. I'm No Economist

The truth is hard, but it's the truth nevertheless.

And the truth is that I never cared too much about sustainability and energy transition.

But ever since I was faced with the challenge of having to study it so I could pay my bills, I gave it a chance to understand the issue a little further.

Nothing like a good ol’ incentive.

Back in February 2021, I was working for a European innovation consulting company, that runs the world's most important event for innovation in the energy sector. They partner with some of the greatest energy sector corporations all around the globe to find, fund, and accelerate the growth of amazing projects for the sector.

I was a scout on the project. It meant that I was responsible for mapping and interviewing startup founders of the energy sector all around the world to match their solutions to the challenges of sector corps.

Most of the challenges faced by corporations are what you can expect big corporations to have: generating new revenue sources, cost reduction, an improvement in operational scalability, and other business challenges.

In this case, differently from other corporations, they were faced with the need to face the net-zero carbon emissions by 2050. That's a tight deadline.

Some of them are good to go. Their primary source of energy is renewable. Or they can, in one or another way, make carbon capture easily.

Others, such as oil companies, have a long way to go.

It was an invaluable experience for someone like me, who is filled with so much cynicism. I still am, honestly. But at least I started understanding what is an evil agenda and what's not.

With the experience gathered from that first opportunity, I then accepted the challenge of doing the same for a European oil company that wanted to understand a little better the landscape for the energy transition in Brazil.

I was so impressed with the landscape for renewable energy here that I couldn't stop researching about it, even off work.

Here are some of the most interesting data points for energy transition in Brazil:

The State of Energy Transition in Brazil

Taking the risk of being apologetic - which I promise I'm not - I began to understand why I never cared too much about this subject.

Or to be fair, why I've never given as much importance to other pressing businesses in Brazil, such as education, crime, legal security, tax structures, entrepreneurship, etc.

The reason is that Brazil is an incredible example of generating energy through renewable sources.

Brazil's main energy generation source is Hydropower, making up 63% of electric energy generation for the country.

This is an incredible contrast to North American generation sources, where Hydropower takes only 8% of the pie, making Natural Gas the main generation source with 44%.

Meanwhile, Europe is optimistic about the growth of renewables, overtaking fossil fuels by 1 percentage point (38% renewables vs 37% fossil fuels).

Brazil hasn't been thinking of renewable sources for a long time, since it doesn't depend so much on geothermal, natural gas, and oil as its main generation source.

So why bother, right?

However, it just so happens that depending so much on one source can bring all sorts of issues, too.

Not only does Brazil suffer from terrible supply distribution (700,000 m3 of all water is in the Amazonian region, one of the least populated areas of Brazil. While only 280 m3 of water is in São Paulo, the most populated area), but we also have periods of drought.

Energy source distribution doesn't sound like a bad idea.

Energy Sector Innovation Investments in Brazil

Talking about incentives, let's follow the money a little bit.

The investments can be divided into public and private. When they're private, they're most likely publicly oriented via government agencies, such as ANEEL (National Electric Energy Agency) and ANP (National Oil Agency).

Although most of the sector's investment comes from government programs, it doesn't mean the money comes directly from public sources.

In Brazil, Oil and Natural Gas companies have an obligation to spend up to 1% of their annual gross revenue on R&D projects.

However a good idea this is, that's easier said than done. You still have to find the right projects to fund.

First, they have to be in line with what the market is chasing in terms of energy consumption. Second, corps need to understand which projects they have the resources to work on depending on the competitive landscape, and third if they think have the resources to help propel a new tech that is going to get them the right financial return.

For innovative, smart corporations, it all boils down to analyzing projects with the right TRL (Tech Readiness Level).

It's simply no good to develop a TRL 1-3 project for a fairly established energy source such as wind or solar because you know there's little competitive advantage. Or by doing a TRL 7-8 on blue hydrogen, which despite being still low adoption, it doesn't really scale for a long-term strategy of reaching net-zero.

So how's the investment landscape for innovation in the energy sector in Brazil?

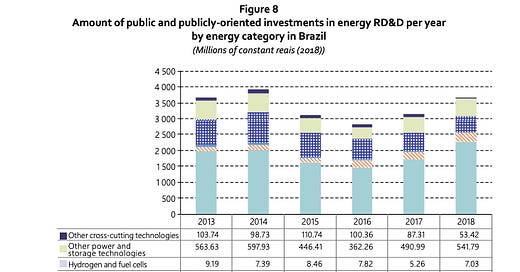

As you can see in figure 8 from the CEPAL study done in 2020, the majority of the R&D investments still go to fossil fuels. This can be explained by the obligation of oil and natural gas companies of applying their gross revenue to R&D.

According to this study, in some years between 2013 and 2018, ANEEL and ANP programs were responsible for 80% of all the innovation fostering investments in the energy sector.

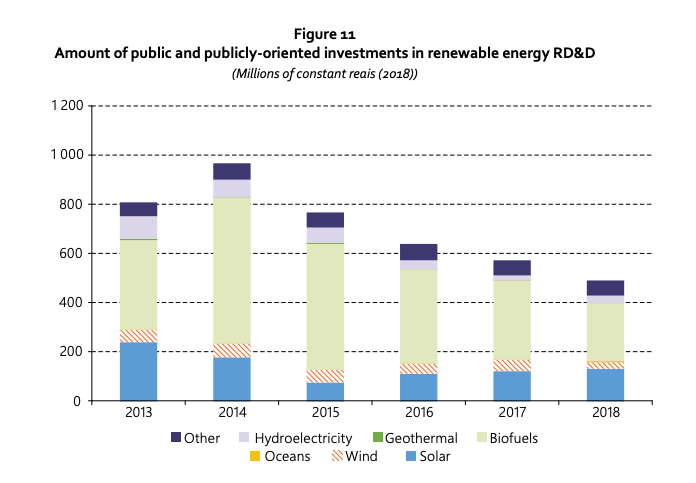

When it comes to renewables, the R&D favorites are biofuels, followed by solar, wind, and hydro.

Personally, I'd love to see some nuclear there. It still gets a bad name, though. Damn Chernobyl.

Yes, these are 2018 data. However, since most of the investments are public or publicly oriented, there's a clear cause correlation between the GDP and the amount of Brazillian Reais invested in the sector.

This is the GDP change from 2013 to 2018:

And these are the Brazillian Reals invested into the sector, via ANP in the same period:

So by the GDP data below, you can probably understand what happened to the investments in innovation for the energy sector:

VC investment for the energy sector in Brazil

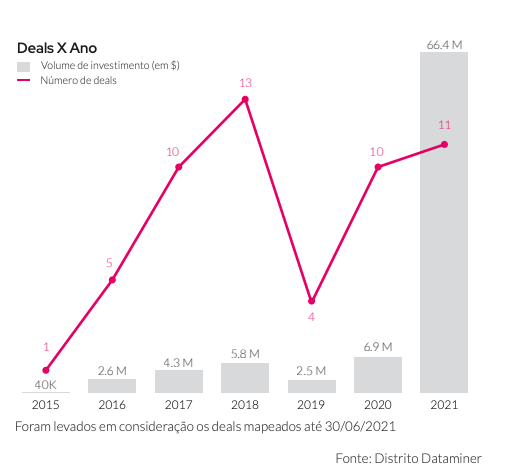

According to Distrito, since 2016, $ 86M were invested into energy tech startups.

According to the 2021 report done by Distrito, from 2016 to 2019 the total annual investment was $ 2M and $ 3M.

This number jumped exponentially ending 2020 with a total annual investment of $ 66,4M in the energy sector:

In my humble opinion, the amount of funding by stage resonates with the TRL of the startups. That is, it's likely that investors are trying to mitigate risks by investing in later-stage startups from the sector:

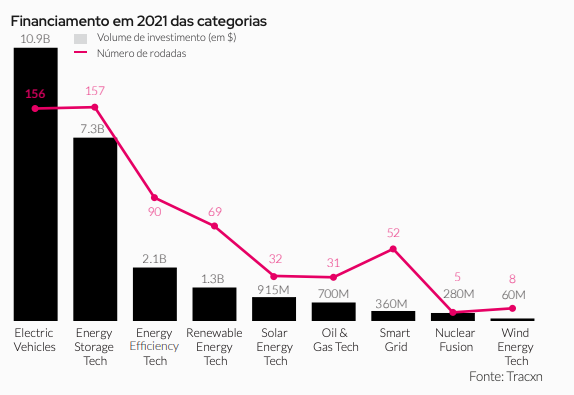

Now, what's interesting to notice is that Brazil, that has 83% of its energetic matrix on renewables, is still going hard on renewable energy generation and distribution. This is fair, since more than 2/3 of it comes from one single source (that is hydro).

But at the same time, regions like the U.S. (a lot to do regarding energy transition), Europe (a little less than the U.S, but still a lot), and China (a lot but less than the U.S) are spending more time and resource developing Electric Vehicle tech and Energy Storage than in energy renewable sources.

So, you’re still emitting carbon but at least storing it more efficiently?

Weird right?

This is the amount of financing across verticals in 2021 worldwide:

What would I'm No Economist do?

Remember that this is absolutely NOT investment advice.

Looking at this data, I would probably try and look for a strategy that would bring me the least amount of risk with maximum upside. This means that if opportunity arised to invest in the sector, I'd probably deploy capital on a 2-fold approach:

Geography

Vertical

From what I understand, geographies have different challenges when it comes to energy transition.

If you look at Brazil, although we have a good scenario when it comes to clean energy generation, we're still too dependent on one single source: hydro.

When it comes to U.S. and Europe, we're still a long way to go when it comes to generating clean energy. Let alone developing a diversified matrix of energy generation and distribution. This was deply discussed since the breakout of the Russia-Ukraine conflict several weeks ago, now.

For Brazil, we can find many opportunities for innovation in energy generation by using current assets. Take a look at floating solar panels for example. Imagine using the abundant inactive bodies of water from our hydropower plants to generate solar energy.

After that, I'd go about finding the most efficient energy storage systems to keep that clean energy and use it at scale. Even before energy distribution systems, which is another huge challenge I have to say.

The point is that for Brazil, when it comes to energy transition and distribution, the top of mind should be decentralization.

The main challenge for Brazil is to establish itself as a reliable energy sector innovation developer. It is to raise the bar when it comes to TRL and be able to reliably take a project out of 1-2 TRL and take it to the 8-9 TRL touchdown line.

For the U.S and Europe, I'd probably go H.A.M. into finding the next big thing. For me, that would be green hydrogen.

If you find a cheap way of doing this chemical process called electrolysis - which in very rough explanation consists of splitting Hydrogen out of H2O, that's a gold mine.

I mean, you can turn it into electricity that is even used in space missions. You can use it to store energy for long periods (replacing the ion-lithium batteries we use for everything). And for mobility on heavy transportation such as aviation, trains, and ships.

There's a lot that can be done on all fronts and I hpe we get ready to do it soon.

Coming soon on I'm No Economist:

For this edition I have very little to say about my portfolio strategy and returns.

Since the last data was about the end of March 2022, I believe it'll generate more value for you if I wait until the end of April so I can have more data regarding my portfolio.

So, for the next edition, I'll be updating you on the current state of my portfolio and how I'm planning to go forward with my strategy.

Thank you so much for your read! Hope you could get some insights.

I'm super excited for next edition.

See you soon!

L.