I'm No Economist #3: The End Is Near: Cheap Money Is Over, Where We Are In The Economic Cycle, Startup Layoffs, My Portfolio Update

Take no advice from me. I'm No Economist.

This is I'm No Economist, a newsletter about my sincere thoughts on the markets.

Take no advice from me, I'm No Economist.

Despite the apocalyptical title of this I'm No Economist edition, I'm a strong believer that this will pass.

It's just the way the financial system is set up.

I'd love to take a trip down memory lane, talk about historical events and remember the ones that led to the global financial crisis of 1929, 2000, and 2008, but there's little time - spoiler alert: it's all about moronic monetary policies and government spending.

For now, I'm just going to give a little context on what's going on and where we are in the economic cycle.

But before my “I told you so” routine, I'd like to say that the mainstream media is only now starting to catch up with the latest events that led to the stage we are in the current bull market.

When I started studying economic cycles, about 4 years ago, circa 2017-18, it was the beginning of the end of the current bull market.

This means that the stage in which I discovered economic cycle dynamics, was already the end of the cheap money party.

Probably why I'm seen as a pessimist or permabear.

Because I've been screaming "the end is near” for about 3 years.

What really called my attention and why I decided to talk about it in this edition, is that it's already affecting the innovation and startups market - something that seemed way too far 18-24 months ago.

The startups and innovation space is something I always cared about deeply.

Not only because I learned most of what I know from the incredible people I met working in this environment - But also because I have many friends working in this ecosystem who are going to be affected by the current events.

Here’s what's going on.

Economic cycles

First, let's go over what economic cycles are.

Economic cycles are essentially macrotrends in which you can base your understanding and decision-making process on your investment allocations. Period.

That said, paraphrasing Naval Ravikant: the more macro someone goes to explain something, the more bullshit you get as a result of that explanation.

I don't fully trust macroeconomic trends.

But but but, here are the (arguably) 4 stages of the economic cycles:

Expansion: lots of new businesses opening, massive funding, and in general, economic growth. Interest rates are usually low, i.e.: there's cheap money around;

Peak: companies’ valuations and indexes start reaching their all-time highs. Generally, interest rates are still low, i.e.: there's still cheap money around;

Contraction: here's when people start realizing it's getting crazy. Growth stagnates, people lose their jobs, and interest rates start increasing;

Bottom: it's usually framed as armageddon. You can't find financing, interest rates are getting way too high and if you tell your dad you're buying financial assets, he'll be super sad and will never forgive himself for your lack of financial literacy (he's probably wrong, though).

The current economic scenario

There's this incredible economist who says that: when lifestyle influencers and wedding planners’ magazines are talking about getting into the stock market, it is likely a sign that we reached the top of the market prices.

We are at the very end of the peak and starting a transition into a contraction phase.

What you're experiencing right now is the feeling caused by the late stage of a bull market.

There are many factors in play.

For the purpose of this newsletter, and to try and prioritize for the least effort and most results in generating understanding, I realized the main factors to monitor come down to these two:

Inflation pressure: supply pressure by Covid and Russia-Ukraine conflict; and demand pressure by money printing via low-interest rates and stimmy checks.

Corporate and household debt: startup layoffs both in Brazil and U.S. and a liquidity crisis followed by a solvency crisis.

Let's get into each of them.

1. Inflation pressure

There are two parts to that problem. First, we have been hit with the second-order effects of a pandemic. Meaning that not only we've been hit with the worst virulent disease of the past 100 years, but we also suffered from its economic effects.

Due to lockdowns, many businesses were closed, and many shut off for good. Less businesses were able to keep productivity at the same levels. So, if there is less productivity, there is less supply. This scarcity makes goods and services get more expensive.

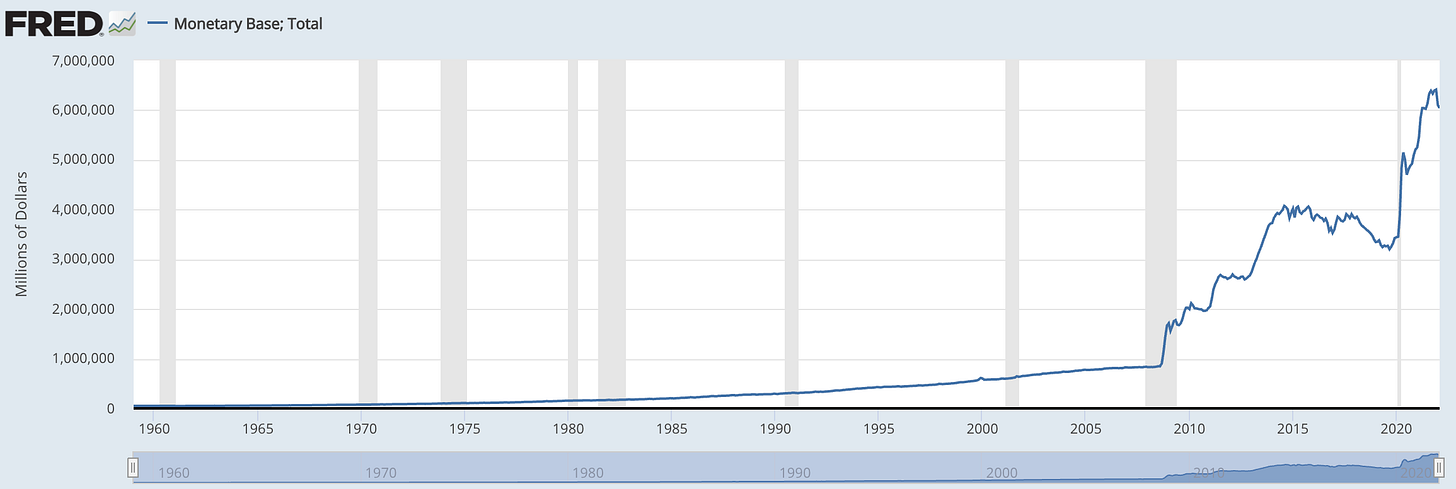

On top of that, to stimulate the economy, countries all around the globe had to make money cheaper. For businesses, borrowing money was almost free, interest rates were incredibly low and it led to a money supply increase to levels never seen before.

To get a better sense of the money printing of this last quantitative easing cycle, 80% of all money in circulation in the U.S. was printed in the past 22 months.

Below is the chart of this blessed event in case you want to check it for yourself. It's f* crazy:

As a reference, in Brazil, the increasing money supply issue exists, and it is dire. But it doesn't compare to the U.S.

Besides, both in Brazil and the U.S., the government distributed money “for free". That's when the stimulus checks hit.

Now, imagine this scenario: increasing demand explained by people with cash they didn't have before, ready to purchase a very low supply of services and goods.

Yes, you got it. It's terrible. Analysts are calling this the perfect storm for inflation.

On top of that, there's another event that's been causing issues on the supply end of this scale: the Russia-Ukraine conflict. Sanctions lead to a supply shortage of energy, commodities, and other goods.

To be clear, inflation was already a problem before the conflict started. The Russia-Ukraine conflict is just the cherry on top of the cake. The current and past U.S. administrations cannot blame it on Putin alone.

2. Corporate and household debt

This week the Brazilian mainstream media and my Linkedin feed were filled with layoff news from unicorns such as Quinto Andar (Real Estate), Loft (Real Estate), Creditas (Fintech), LivUp (Health Food Delivery) and Facily (E-commerce).

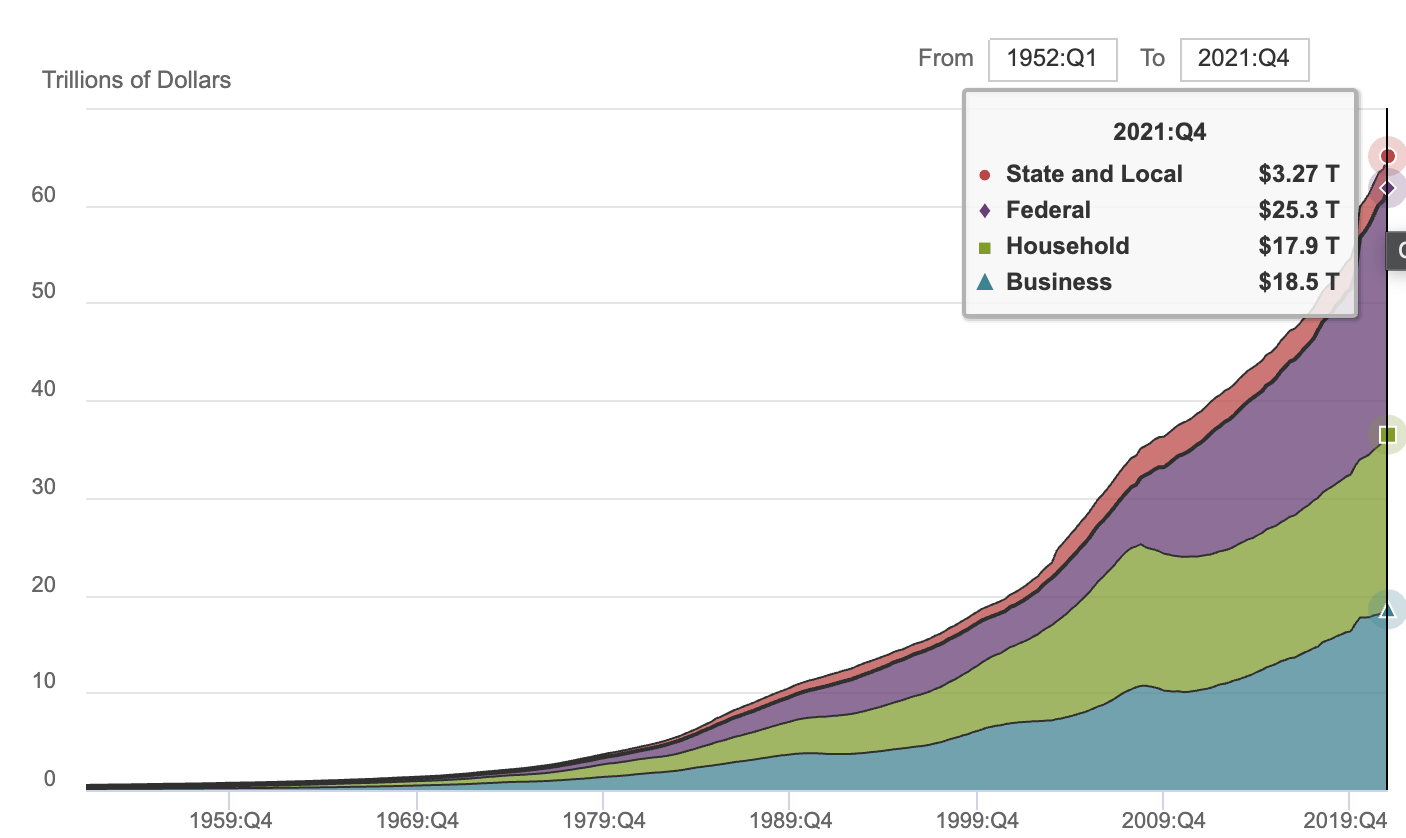

It's getting riskier to invest in financial assets, given that people and businesses are drowning in debt.

And if it's riskier to invest in the stock market, imagine investing in startups.

That's exactly what's going on around the world and you can already see the effects of the money shortage.

The unicorn makers, such as SoftBank and Tiger Global are already seeing the writing on the walls and reacting to the end of the cheap money era.

What they're seeing is unicorns that raised in preposterous valuations - and spent their funds’ money with the same attitude as Vivian in Pretty Woman - may not be able to reach those same valuations should they try to raise again - leading to an increasing doubt in these companies’ solvency.

The chart below shows the increasing debt in households in the U.S. You can see 2 spikes that make it especially concerning: 2009 and 2020.

Those were the years when businesses and families had to borrow money to continue operating at the same cost levels they were before losing their revenue streams.

Sadly, we're again seeing history being made.

In Brazil the situation is similar. Household debt reaches 77% of the households within the country.

And with unemployment at 11%, it will be a difficult situation for these families to get out of.

This is very sad and points to a very somber future. But that's a narrow-minded narrative that should be debated. It's an opportunity to learn how to deal with these situations.

I'm with Chamath Palihapitiya and I say let the market be the market. (btw, shoutout to my friend Guilherme Lima for sending me this Chamath link exactly one year ago over e-mail, while discussing macro trends).

The best way to prepare for a downturn

Look, this is the first time I'm experiencing this kind of scenario. One can only expect if and when we will meet on the other side. Mr. Marley said it right: "Time will tell”.

I'm not sure I'm prepared for it. But, unlike most financial professionals that are in the same asset allocation challenge, I'm studying history, saving money, and allocating resources with the best risk/reward ratio I know how to.

There is no “timing the market" or trying to guess when it's going to happen.

These are economic cycles. They go round and round and back again.

What I'm doing is buying fire insurance before I really need it.

You should probably do the same.

But don't listen to me. I'm No Economist.

My portfolio update

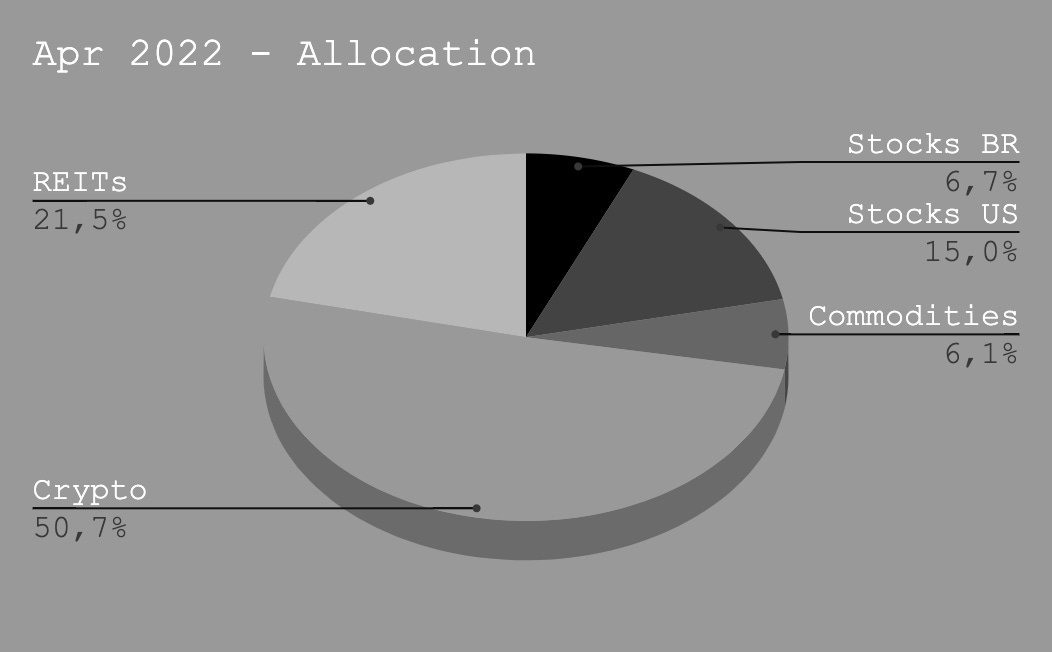

As the end of April 2022 approaches, I have updates on the portfolio allocation, YTD, and MoM performances of each asset class.

I'm still deep into crypto, but as interest rates hikes approach, I'm starting to develop a taste for REITs (Real Estate Investment Trusts). It's going to get worse before it gets better, but it's a good exposure opportunity.

This is what the current allocation looks like:

When compared to March's allocation - around 9% - REITs are the one asset class that is getting more important in the overall allocation. As a consequence, Crypto went down a bit.

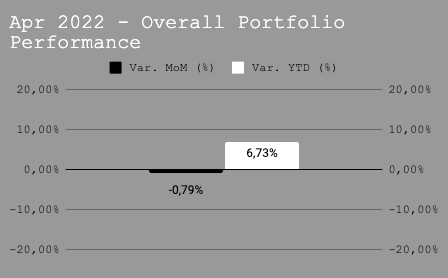

In regard to the overall performance of the portfolio, it's been a lean month. A -0,79% performance when compared to March. But it's good on the YTD analysis.

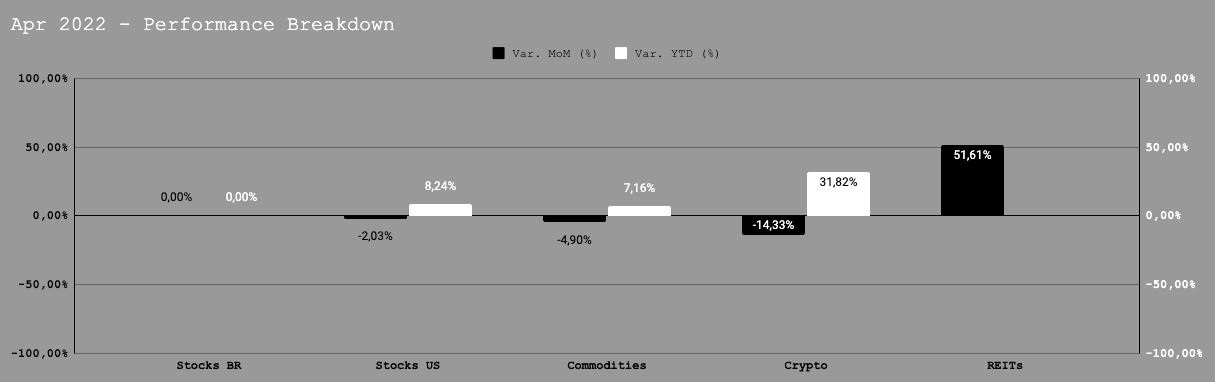

When breaking down for each asset class, what's really saving my year is the Crypto allocation, with ~32% return YTD, even with the -14% MoM.

If REITs were there, It would put this portfolio in the double-digit positive returns arena, near 15%.

Now what I'm excited to see is the commodities portion of this portfolio, where I've been eating punches since my first buy, in 2020.

Next on I'm No Economist

I hope to bring some updates as to the end of the cheap money era and how my portfolio is reacting to it.

For now, thank you very much for reading I'm No Economist.

Don't forget to subscribe to the newsletter and share it with your friends!

Talk soon,

L.

What a great article, congrats!!! This text contains evidences, facts with friendly and amazing narrative!!!