🏄♂️ A Quick Macro Overview: You Probably Heard About #11 [I'm No Economist]

Inflation 2nd wave, M&As going off in Brazil, I'm No Economist gossiping about the finance world

Welcome to a new issue of You Probably Heard About 🎉

📈 Stay informed and ahead of the game with I'm No Economist weekly issues!

🔥 Every Friday, receive a comprehensive summary of big numbers, hot topics in finance and tech, and what's crucial to keep on the radar.

💡 If you'd like to get future issues and be in the know about the latest trends, subscribe today!

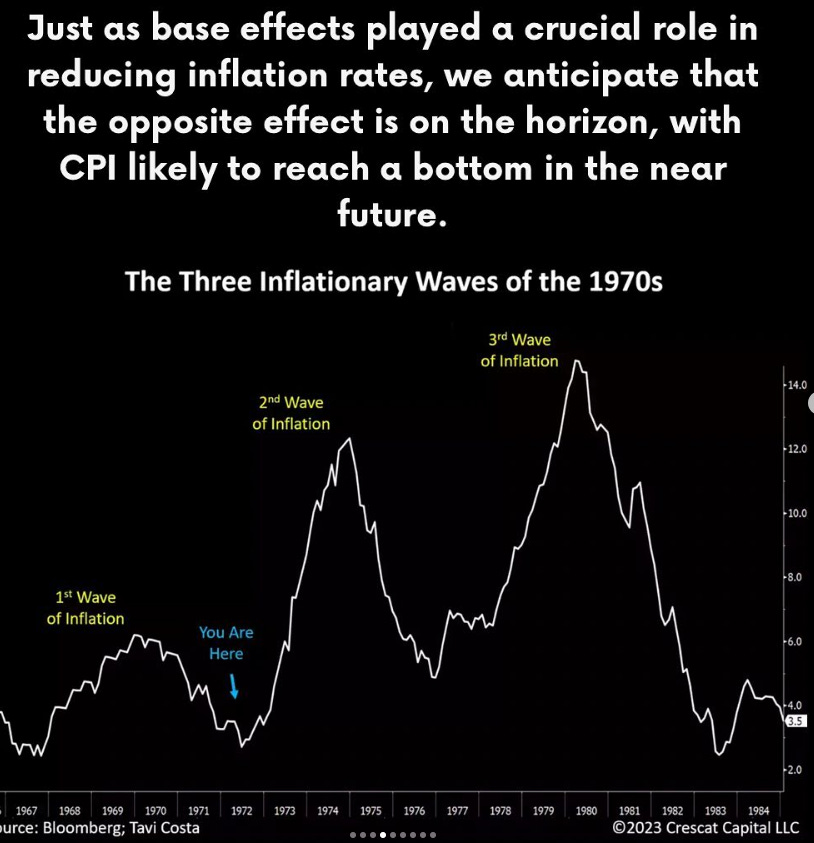

🏄♂️ Are you ready for inflation's 2nd wave?

This week, I've come across analyses on inflationary waves. In the U.S., CPI increase is slowing down, while unemployment rates remain below expectations, pointing towards a soft landing. However, the Fed is still considering 1 or 2 rate hikes to curb inflation.

Meanwhile, global government spending is increasing, and debt-to-GDP ratios, especially in the U.S., are soaring, making fiscal dominance a realistic scenario. Moreover, there's a trend of increasing money supply globally, with countries like Brazil planning to cut rates soon.

When comparing inflation waves historically, the 1970s period is often cited, but we must consider the rapid evolution of technology today, which has a deflationary impact. All of that to say that, in conclusion, tech brothers and sisters, it's your turn to address these challenges.

🤝 M&As going off in Brazil

This week a few M&A transactions popped on the news. We can expect more of those coming in the next few months since IPOs have slowed down lately.

Enjoei (BVMF: ENJU3), the retail marketplace for second-hand items acquired Elo7, pushing Enjoei's stock price up 11,7% on the day of the acquisition on July 17th. The transaction amount was not disclosed. Both companies are going to be operated independently, but XP Investimentos sees the acquisition as an opportunity to leverage synergies between them.

Sinqia (BVMF: SQIA3), a leading software company for the financial sector, famous for its M&A strategy over the past years is about to be sold for R$2,4B ($480M) to Evertec (NYSE: EVTC), a Puerto Rican full-service transaction processing business. The acquisition price puts Sinqia's valuation at a 20% premium. HIX Capital stands to make a 12x return on the transaction from an investment made 7 years ago.

Zarpo, an online travel agency that transacts yearly R$150M (~$30M) was acquired by Bancorbrás. The transaction amount was not disclosed. KPTL, the firm behind Zarpo since 2013 will still be invested for the next 3 years while Daniel Topper continues in his role as CEO, serving their upper-middle-class clients.

I was lucky to be an early employee in Zarpo, a company where I learned a lot from the founders and that made me fall in love with the digital marketing world, since 100% of Zarpo's sales are online.

🌳 Michael Moritz is leaving Sequoia

Oh boy, I'm No Economist is about to become the gossip channel for the finance world. Here we go: Michael Moritz is leaving Sequoia after almost 40 years as a partner at the company.

The journalist-turned-VC is parting ways with Sequoia right after their split into three distinct firms in June. These two events happening so coincidently close to each other make investors wonder what's the future of Sequoia, and rightfully so.

Moritz will still be part of the Sequoia Heritage team, a $15B global fund that is managed independently, and he is a founding LP with a $150M investment.

🇧🇷 Brazil

Tuesday, July 25th

Monthly economic optimism (Previous 92.3 // Forecast 92 // Consensus 89.9)

Wednesday, July 26th

Foreign direct investment (Previous BRL 5.38B // Forecast BRL 6.7B)

Current account (Previous BRL 0.649B // Forecast BRL 0.5B)

Friday, July 28th

Monthly IGP-M (Previous -1.93% // Forecast N/A)

🇺🇸 U.S.

Monday, July 24th

Composite PMI (Previous 53.2 // Forecast 52.6)

Tuesday, July 25th

Monthly house price index (Previous 0.7% // Forecast 0.5%)

Wednesday, July 26th

Monthly new homes sales (Previous 12.2% // Forecast -4%)

Fed rates decision (Previous 5.25% // Forecast 5.5%)

Thursday, July 27th

Quarterly GDP growth (Previous 2% // Forecast 1.8%)

💌 If you like I'm No Economist, share it with a friend

I'm No Economist is a newsletter about global investment trends 💰

Here you'll read research digests and updates on what's going on in Venture Capital, Private Equity, and Global Macroeconomy - all subjects I'm fascinated with and have strong opinions about.

Talk soon,

L.