Beyond Carnaval: Fernando Haddad Is Just The Tip

Concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Welcome to I'm No Economist

I'm No Economist is a newsletter dedicated to deciphering Brazilian potential for global investment. Subscribe below to read it every week.

IN TODAY'S BEYOND CARNAVAL:

A Broken Clock Is Right Twice a Day

Fernando Haddad Is Just The Tip

Beware Of Narratives

Help Us Make I'm No Economist Better:

So, 2024 has been wild—in the best way. I’m No Economist has grown a ton (yes, humble brag), and it’s all because of you. Now, as we start scheming for 2025, we figured, "Why not ask the people who actually read this thing what they think?" Crazy idea, right?

This questionnaire won’t take long, and it’ll help us make the newsletter even better—or at least prevent us from going completely off the rails. Your input is gold, and we promise to use it wisely.

Thanks for sticking with us, sharing your brainpower, and letting us be part of your inbox. 😎

A Broken Clock Is Right Twice a Day

Two years ago, I wrote about Brazil’s election results, analyzing the economy and the challenges ahead. I predicted the Brazilian Real would hit R$6 to the US dollar, but I expected it to happen by 2023. My fundamentals were right, but my timing was off - which, in investing, means I was wrong. Timing is everything, after all. Here's the article:

Now that the prediction has materialized, it’s a good moment to revisit those fundamentals and explore whether Brazil’s currency can regain strength in today’s economic climate. Let’s dive in.

Fernando Haddad Is Just The Tip

Last week, Brazil’s Finance Minister Fernando Haddad announced spending cuts of R$70 billion and a plan to tax the wealthy. Headlines quickly latched onto the idea that "the market" doesn’t like taxing the rich, blaming this narrative for the sharp devaluation of the Brazilian Real, which crossed R$6 to the dollar.

But this explanation misses the point entirely. The real issue lies in the R$70 billion figure itself. For an economy grappling with increasing debt and fiscal imbalances, this cut is seen as insufficient to address structural challenges.

The Brazilian Real devaluation reflects a lack of confidence in Brazil's fiscal strategy, not its rhetoric on taxing the wealthy. Investors aren’t allergic to taxing the rich - they’re skeptical about fiscal credibility.

It Came Down To Fiscal Doubts

Fiscal Dominance

Inflation has been one of the biggest global themes since before the pandemic. From the U.S. to China the way to deal with inflation is to make credit more expensive. You do it by raising interest rates.

But it means that every time an economy increases the cost of borrowing money to control inflation, it makes their debt more expensive. That's a pickle called fiscal dominance. They give it that name when you can't use base interest rates to control inflation without getting into major debt.

Brazilian Government Spend

Brazil’s rising government spending over the past decade has raised concerns about fiscal discipline. Record-high expenditures this year alone, even with revenue growth, have heightened fears of inflation and increased debt reliance.

Of course markets view this unchecked spending as a sign of economic instability, prompting capital flight and pressure on the Real. Trust is crucial, and Brazil’s growing deficits have amplified doubts about its fiscal management, leaving the BRL vulnerable to global market dynamics and domestic economic uncertainty.

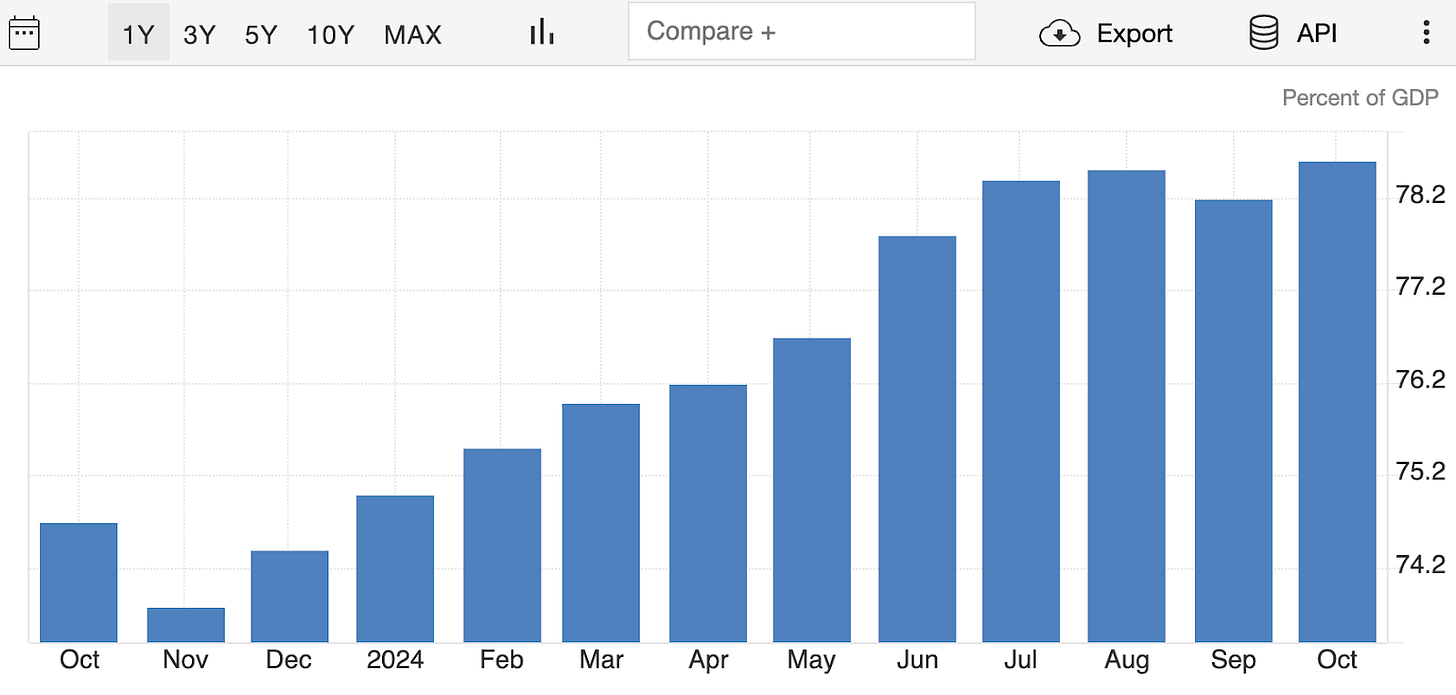

Brazilian Debt-To-GDP

Brazil’s rising debt-to-GDP ratio, now exceeding 78%, signals growing fiscal strain. This trend raises red flags for investors, as higher debt burdens can limit economic flexibility and increase default risks. Concerns about debt sustainability erode confidence in the Real, contributing to its devaluation as capital flows shift to more stable currencies like the USD.

Brazil's Foreign Exchange Reserves

Brazil’s foreign exchange reserves have remained relatively stable, with a slight increase in recent months. While reserves provide a buffer against currency volatility, the BRL’s devaluation suggests they are insufficient to offset broader macroeconomic concerns like rising debt and fiscal imbalances. Stable reserves alone can’t restore investor confidence when structural risks loom.

Beware Of Narratives

It’s tempting to attribute BRL devaluation to polarizing narratives like "markets hate taxing the rich." But this oversimplifies a complex issue. Fiscal credibility isn’t about who pays - it’s about whether the numbers add up. In Brazil’s case, a R$70 billion cut falls short of addressing mounting debt and structural fiscal challenges.

Media framing that pits "markets" against "the people" can distort the real debate. It reduces nuanced economic issues into a superficial rich-versus-poor conflict, diverting attention from the real drivers of financial instability. For policymakers, analysts, and citizens alike, the lesson is clear: numbers matter more than slogans.

We must resist the urge to fall for easy narratives and instead scrutinize the data and policies underpinning the economy. Only then can Brazil build a sustainable fiscal framework that restores investor confidence and strengthens its currency in a meaningful way.

Be careful out there.

BlackRock's Optimism Towards Brazil: BlackRock emphasizes the importance of a long-term perspective when investing in Brazil, highlighting the country's potential despite short-term challenges. The firm advocates for resilience and strategic vision to capitalize on Brazil's economic opportunities. Source

Softplan's 12th Acquisition: After securing R$ 250 million through debentures, Softplan acquired Runrun.it, a startup specializing in process and task automation for teams. This move enhances Softplan's operational efficiency vertical, aiming to provide more comprehensive solutions to clients. Source

Zig's Funding from Kaszek: Zig, a fintech focused on the entertainment sector, raised R$ 155 million in a Series B extension led solely by Kaszek Ventures. The funds will support expansion into new regions and bolster international operations in Mexico, Portugal, and Spain. Source

Kinea's Infrastructure Credit Fund: Kinea Investimentos launched a R$ 400 million infrastructure fund (FIP-IE) to invest in debentures of mature projects. This initiative targets underfunded niches, focusing on sectors like highways, sanitation, and distributed generation.Source

📩 Partner with I'm No Economist

Deciphering Brazilian potential. Generating expert intelligence and strategic insights for the Brazilian investment market.

Every Thursday 06:09 am (BR time), the Beyond Carnaval newsletter offers concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Delivered on the first Saturday of the month at 06:09 am (BR time), the Open Zeitgeist newsletter provides a space for both Brazilian and "gringo" guests to share their perspectives on Brazilian investment opportunities.

Investors are closely looking for opportunities in our country. It is our job to decipher Brazilian potential.