I'm No Economist #17: 🗝 UBS Global Family Office Report 2023 - I Read It So You Don't Have To

Take no advice from me. I'm No Economist

👂 Subscribe to get weekly I'm No Economist

This article is a longer digest and provides a deep dive into a specific theme. This kind of content is less frequent and I've been maintaining a 30-day-ish frequency, with 15+ editions.

But if you also enjoy a quick summary of what happened in the week, subscribe to get You Probably Heard About.

It is sent out every Friday by the end of the day and is a summary of big numbers, what was hot in finance & tech this week, and what's important to keep on the radar for next.

This is the 2nd digest of UBS’ Global Family Office Report

For further comparison, refer to I'm No Economist #5 below:

🗝 UBS Global Family Office Report 2023

Last year's report contemplated 221 family offices globally, versus 230 this year.

Consequently, the total net worth increased by $2.8B to $495.8B, an average family Office worth of $2.2B.

This year UBS is probably contemplating its humongous Credit Suisse acquisition, which makes this data even richer (both data-wise and in asset management size).

TL;DR:

Strategic Asset Allocation (SSA):

Fixed income: now that central banks have decided to take a strong stance against demand inflation, short-duration, high-quality fixed income became the true hero for FOs portfolios;

Private equity: the SSA for this asset class is shrinking, but only for direct investments. It's time to trust experienced managers to boost returns;

Themes of interest: when investing directly, private tech companies are the preferred theme, followed by health tech, automation & robotics, and green tech.

Succession vibes:

63% of FOs say their primary focus besides investing is the generational wealth transfer, but only 42% have a wealth succession plan for family members and a governance framework to do so;

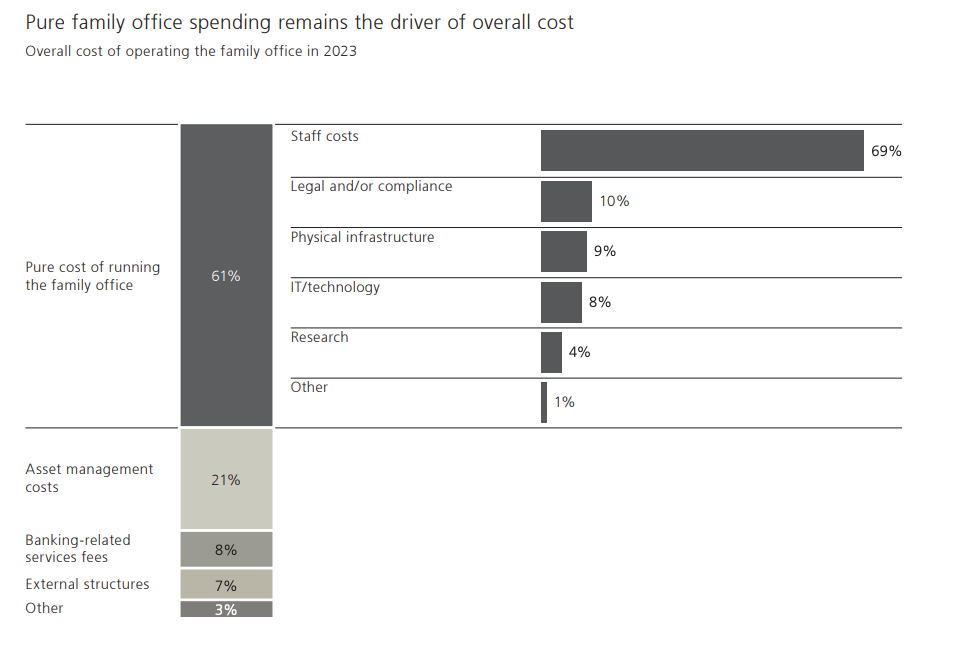

Staffing is 61% of the cost of running a FO, while only 8% of the cost is IT/tech. There's probably room for improvement.

Let's get into it!

💌 Share I'm No Economist with your friends

I'm No Economist is a newsletter about global investment trends.

Here you'll read research digests and updates on what's going on in Venture Capital, Private Equity, and Global Macroeconomy - all subjects I'm fascinated with and have loosely held, strong opinions about.

Share I'm No Economist with your friends and stay up-to-date with the latest trends in the money world 💰

Strategic Asset Allocation

by asset class and region

Since the recent cycle of interest rate hikes, the attraction to high-quality, short-duration bonds has increased, particularly in the U.S. The appeal is stronger towards short-duration because FOs in the U.S. are anticipating a decrease in interest rates soon.

The most notable differences in SSA are in fixed income and private equity. These changes are driven mainly by macroeconomic shifts, that vary in intensity among different geographies.

Macroeconomic decision-making

When comparing the decision-making based on macroeconomic trends, concerns about geopolitical tensions and interest rate hikes have both increased.

While in 2022, only 21% of FOs responded they were concerned with geopolitical circumstances, in 2023 the number rose to 35%. The same happened to the rise in inflation rates, going from 11% in 2022 to 25% in 2023.

The recession is replacing valuation concerns, a problem that last year was cited by 20% of FOs. Notably for the Americas, recession and inflation rates are more significant problems than global geopolitical circumstances.

For Europe that is a problem for 37% of FOs, while 49% for Switzerland. The Switzerland bank issue and the Ukraine-Russia conflict may have contributed to this specific set of data.

Capital concentration

North America leads capital concentration, with a 5% increase compared to the previous report. What may also be a result of geopolitical shifts, Greater China and the Middle East are decreasing their capital concentration, while the recession may be the cause of Latin America losing some of it:

Themes of interest

ESG is a theme of interest for FOs, but green tech is not in the top 3 priorities. Smart mobility, water scarcity, and circular economy appear on the bottom half of the top 12 themes - all addressable by ESG strategies:

Direct Investments vs Managers

It's challenging to cover everything all at once, particularly in private markets and across multiple themes and regions. That's why FOs prefer outsourcing their private equity allocation to funds.

Accordingly, there's an increase in interest for hedge fund managers, good news for those with macro and multi-strategy funds that contemplate macroeconomic uncertainty. UBS describes:

“Family offices have confidence in hedge funds’ ability to generate investment returns, as central banks drain excess financial liquidity from markets and macroeconomic uncertainty persists.”

Succession vibes

and how much it costs to manage a FO

Although 63% of FOs say their primary focus besides investing is generational wealth transfer, only 42% have a wealth succession plan for family members and a governance framework to do so.

This problem is more evident among smaller family offices, with assets between $100M and $250M. But FOs with assets above $1B also suffer from not having a governance framework for succession.

There's an opportunity for process improvement around risk management beyond investment, namely cyber security. Only 44% of FOs have a framework to check for irregularities and possible attacks.

Staff costs are the vast majority of where the expenses go, taking up to 69% of the overall costs of running a FO. While IT/tech is only 8%.

On a personal note, there's probably room for improvement given tech advances with AI. Even though managing wealth is still seen as part science, part art.

Feeling FOs pulse

It was cool doing this for the second year in a row. You can't help but compare the different pictures or even make it a movie.

When reading last year's digest, the changes that clicked with me were the increasing concerns with geopolitical tensions and inflation. Valuations gave place to the recession, strengthening the commonplace for macroeconomic decision-making.

Succession vibes also strike me. It's the second time this week I see a global source cite the problem with Boomers’ wealth. This article from Daily Upside talks about the how 1st generation of wealth comes mainly from small and medium business owners that are planning succession now.

While having to deal with so many variables to make the right choices, FOs are eager to outsource some of the investment picking and managing. That's natural and inherent to an uncertain scenario.

With so many processes, the management of FOs has an interesting space for tech to tap into. To perform well in a job that is to think about the future while managing day-to-day is still challenging and can use some improvement.

Thanks for reading to I'm No Economist 🎉

I'm No Economist is a newsletter about global investment trends.

Here you'll read research digests and updates on what's going on in Venture Capital, Private Equity, and Global Macroeconomy - all subjects I'm fascinated with and have loosely held, strong opinions about.

Share I'm No Economist with your friends and stay up-to-date with the latest trends in the money world 💰

Talk soon,

L.