Beyond Carnaval: Brazil, The U.S.'s Giant Agribusiness Partner

Concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Welcome to I'm No Economist

I'm No Economist is a newsletter dedicated to deciphering Brazilian potential for global investment. Subscribe below to read it every week.

IN TODAY'S BEYOND CARNAVAL:

The U.S. Investment In Brazil: Figures & Facts

Agribusiness: The Apple (Soy, Coffee, Meat) Of The Eyes

Brazil, a Pawn To Geopolitical Tensions: BRICS vs NATO

These past weeks we have been showing the position Brazil takes when it comes to being a destination for foreign investment. We talked about how Europe and Latam are eyeing Brazil with both government and private initiatives.

Last week Nat Vasconcellos wrote one of my favorite IANE pieces so far, covering how China has been a strategic partner to Brazil. Today, it's time to talk about another important partner, the U.S. We're excited to have been able to draw a picture of how Brazil is still an important piece in the global geopolitical and economic landscape. Let's see what today's article takes us:

The U.S. Investment In Brazil: Figures & Facts

U.S. investments in Brazil reflect a complex, yet promising landscape that has attracted significant capital across various sectors over the past five years or so. Understanding the ebb and flow of these investments highlights Brazil’s growing role in Latin America and shows the challenges investors tend to face - bureaucracy, regulation, taxes, you know the drill. In the meantime let's look at the major trends shaping U.S. investments in Brazil.

A Snapshot of Foreign Direct Investment (FDI) Growth

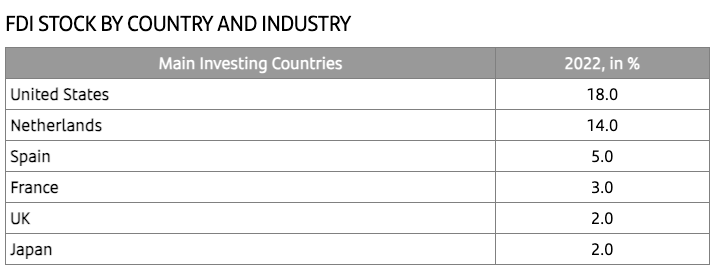

The United States has consistently been one of the largest foreign investors in Brazil, reaching 1st place, and amassing a stock of around $246.3 billion by 2022, which represents roughly ~20% of the country’s total FDI, as per Apex Brasil and Brazilian Central Bank.

2022 was a good year for Brazil’s overall FDI inflows, rising from $50.6 billion in 2021 to $86 billion in 2022 - almost 70%. This growth was mainly driven by reinvested earnings, which means an increased appetite for Brazil’s high-growth sectors by U.S. investors.

But it's important to note that in the first eight months of 2023, FDI inflows totaled USD 37.9 billion, down by 36% compared to the same period one year earlier according to the Central Bank.

Sectoral Distribution of Investment

U.S. investments in Brazil span a variety of sectors, though some dominate more significantly. Here’s where the U.S. is putting its money:

Financial Services: Financial services lead the charge, accounting for about 19.2% of total FDI. This influx reflects the ongoing modernization of Brazil’s financial infrastructure and the broader shift toward digital financial solutions (source).

Commerce and Non-Metallic Minerals: The commerce sector alone commands 8.1% of FDI, with non-metallic minerals close behind, showcasing an American interest in consumer goods and industrial commodities that are crucial to Brazil’s domestic market and export base (source).

Energy: Oil and gas extraction stands out, comprising around 7.4% of U.S. investments, although renewables are gaining ground as sustainability pressures encourage investors to diversify within the energy sector (source).

Agribusiness: The Apple (Soy, Coffee, Meat) Of The Eyes

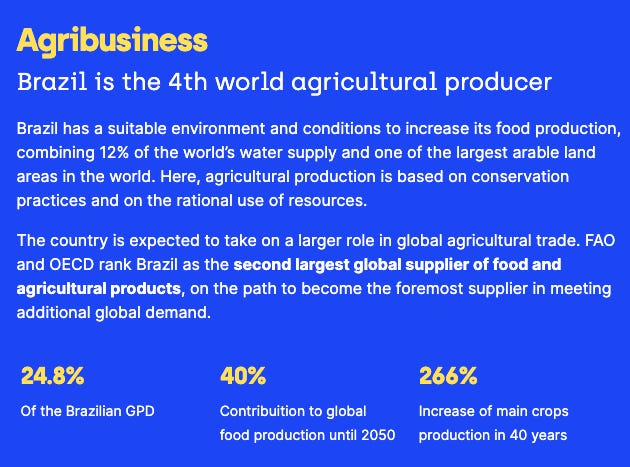

With over 388 million hectares of agricultural land, Brazil stands as one of the world’s largest producers of soybeans, corn, coffee, and beef. The U.S. has found significant opportunities in supporting Brazil’s ability to scale this production, investing in everything from machinery and advanced agricultural technology to bioengineering solutions that enhance crop yields and resilience against climate change.

The sector’s global significance is further reinforced by Brazil’s trade partnerships with major economies, allowing Brazilian produce to access a vast international market, making agribusiness a high-value sector for U.S. investors (and other global economies for that matter) aiming to capitalize on food demand trends.

What's cool is that the U.S. is eyeing Brazil to be an important exporter for commodities. According to the U.S. Government, Brazil has actively pushed for modernization across agribusiness, introducing favorable policies and incentives to attract foreign capital. With U.S. investors backing technology advancements in precision agriculture and digital monitoring systems, Brazilian farms are becoming more efficient, scalable, and globally competitive.

Brazil Could Be a Pawn To Geopolitical Tensions: BRICS vs NATO

When revising this article before publishing, Nat Vasconcellos advised me to save this topic for Open Zeitgeit's next edition, which comes out this Saturday, November 2nd - and I will. But I couldn't keep myself from, at least, mentioning how this tension could become a problem for Brazil.

The geopolitical irony of both the U.S. and China investing heavily in Brazil lies in their opposing strategies and Western / Eastern rivalries. While the U.S. sees Brazil as a key ally in strengthening democratic ties and securing economic influence in Latin America - (hi CIA!), China views Brazil as a strategic player in its Belt and Road Initiative, tapping into Brazil’s vast natural resources to support its global ambitions.

Both China and the U.S. bring significant capital to Brazil, yet each aims to advance its own economic and political foothold, indirectly placing Brazil in the position of balancing these influences - imagine if Brazil has to take a stand. That geopolitical tension will definitely turn into an epic poem sang for generations to come.

While this dual investment presents opportunities it's also a delicate challenge, leveraging both relationships without becoming a pawn in the broader U.S.-China feud. Fun to watch, not to participate in. Okay, maybe not that fun to watch.

Vale Recruits New CFO: Vale has appointed Marcelo Bacci, Suzano's former CFO, as its new Chief Financial Officer. Bacci brings a wealth of experience from Suzano, aiming to strengthen Vale’s financial and strategic initiatives in mining and beyond. Source

Nubank Expands into Mobile Service: Nubank has launched NuCel, entering the telecom sector to offer mobile services in Brazil. The move diversifies Nubank's services beyond banking, aiming to expand customer engagement through bundled offerings. Source

Caution Amid Optimism in Brazil’s Economy: André Esteves, founder of BTG Pactual, expresses cautious optimism about Brazil’s economy, highlighting opportunities but warning of risks tied to fiscal and monetary policies. Esteves advocates careful economic management to sustain growth. Source

📩 Partner with I'm No Economist

Deciphering Brazilian potential. Generating expert intelligence and strategic insights for the Brazilian investment market.

Every Thursday 06:09 am (BR time), the Beyond Carnaval newsletter offers concise reflections, digests, and highlights of the week's significant news within Brazil's investment and innovation landscape.

Delivered on the first Saturday of the month at 06:09 am (BR time), the Open Zeitgeist newsletter provides a space for both Brazilian and "gringo" guests to share their perspectives on Brazilian investment opportunities.

Investors are closely looking for opportunities in our country. It is our job to decipher Brazilian potential.